Visa vs Mastercard: Why I prefer to invest in one of them

Visa and Mastercard form a global duopoly in card payments, capturing 90+% share of network purchase transactions (Outside China), with American Express, Discover and JCB fighting over the small remainder.

Some investors prefer to own both networks as a paired “toll-booth” position in their portfolio. I take a slightly different view and lean more toward one of them as the structurally stronger long-term compounder (though at the right valuation I would still consider owning the other).

This matters because the payment networks face two major headwinds today:

- Rise of domestic instant Account to Account (A2A) schemes (PayNow in Singapore, UPI in India, PIX in Brazil, FedNow and RTP in the US and others) designed to replace card-based domestic payments.

- Intensifying regulatory and legal pressure on interchange and scheme fees, especially in the US and Europe

In this article I lay out,

- Why one of the duopoly is growing faster & is better positioned to tackle the headwinds

- Why a potential buy opportunity may be coming up

- Valuation buy levels where I would be interested in

- My specific portfolio next steps related to Mastercard & Visa

The Faster Grower

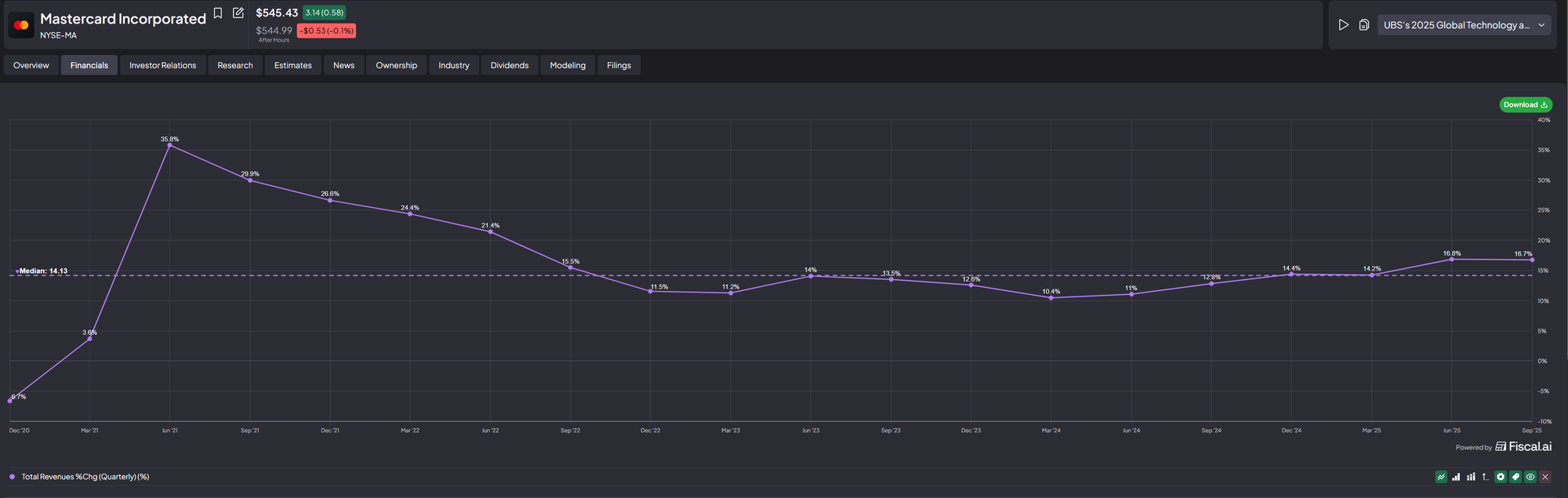

Over the last five years, Mastercard has grown faster than Visa on topline revenues. Using median year-over-year growth across 20 quarters:

- Mastercard revenue growth: ~14 percent

- Visa revenue growth: ~11.6 percent

(see below 2 diagrams)

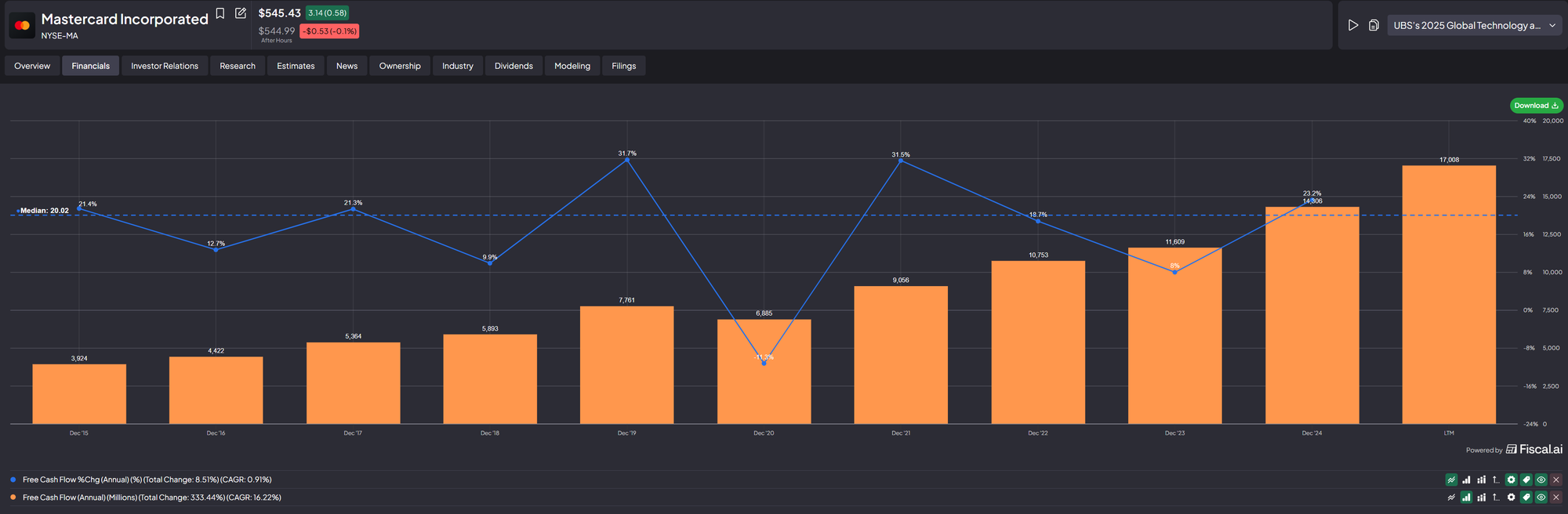

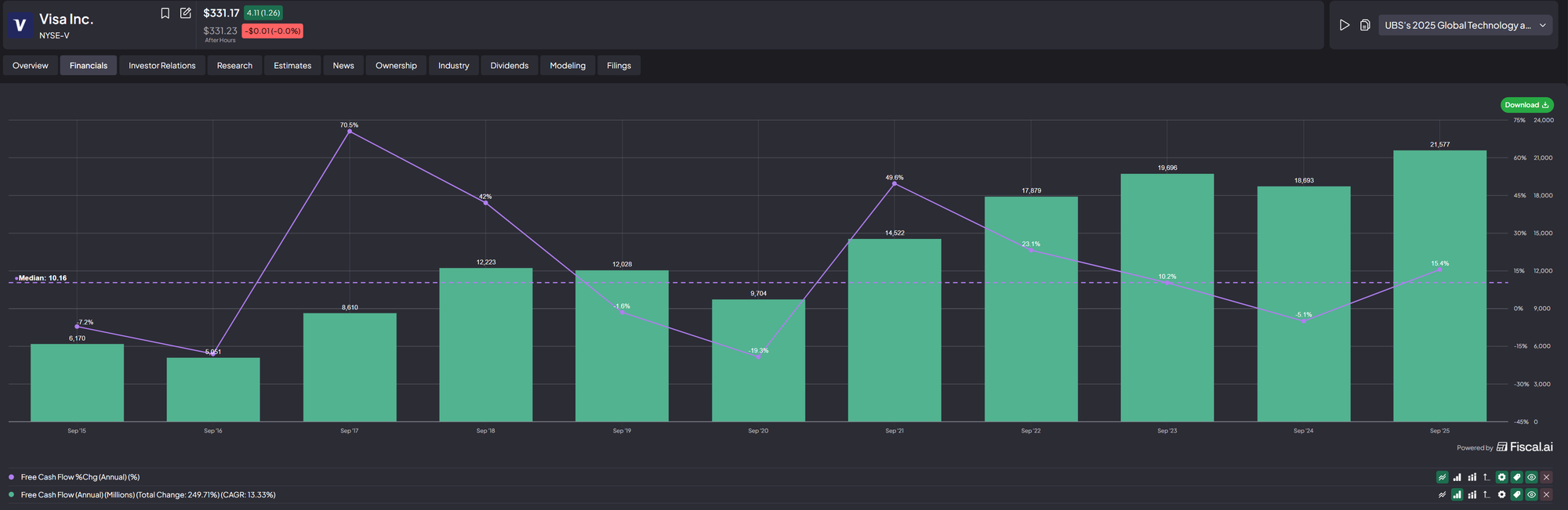

Since both are in a more mature state of growth with highly optimized Free Cash Flow (FCF) margins, we can check the FCF trend to ensure alignment. Over the same period:

- Mastercard free cash flow growth: ~20 percent

- Visa free cash flow growth: ~10 percent

This means Mastercard is compounding FCF at roughly 2x the pace of Visa, while also growing top line faster.

(See 2 diagrams below):

Mastercard’s outperformance is not random. It stems from two structural mechanics that directly tie back to the headwinds outlined earlier. These mechanics explain both why Mastercard is growing faster today and why it is better positioned if domestic A2A schemes or regulatory constraints intensify.

Cross-border advantage

Using each company’s most recent Q3 FY2025 filings, cross-border revenue share as % of payment-network revenue are as follows:

Mastercard: 31.3%

Visa: 27.5%

Across the last 10 quarters:

- Mastercard cross-border revenue growth: ~21 percent YoY

- Visa cross-border revenue growth: ~10.3 percent YoY

Mastercard is growing cross-border roughly twice as fast, while cross-border already accounts for a larger portion of its network revenue (see diagrams below)

There are 3 important implications from this observations.

1. Higher yields drive higher revenue growth

Cross-border transactions carry the highest pricing yield in the entire payment ecosystem because of additional FX, assessment and processing components. Mastercard’s higher mix plus faster growth naturally lift overall revenue and FCF growth.

2. Cross-border hedges Mastercard against domestic A2A substitution

UPI, PIX, PayNow, and FedNow predominantly displace domestic debit and P2P flows.

Cross-border A2A is structurally harder to build due to:

- Fragmented regulatory regimes

- FX and settlement complexities

- Lack of global interoperability

This means Mastercard’s revenue mix has lower A2A substitution risk relative to a network with heavier domestic debit weighting (i.e. Visa).

3. Mastercard’s global skew reduces exposure to US regulatory pressure

Mastercard earns a meaningfully higher proportion of its revenue from international markets than Visa. While the exact % varies, Mastercard's proportion of international to USA consistently runs roughly 8 to 12 percentage points higher than Visa.

This matters because:

- The US is the most hostile regulatory region for payment networks (Durbin debit caps, proposed Credit Card Competition Act, merchant litigation, etc.).

- The EU caps interchange, but Mastercard’s growth has come from regions with rising card penetration such as Europe, Brazil, Southeast Asia and MENA. Visa historically had stronger US debit penetration, which is exactly the segment most exposed to regulation and A2A.

The result: Mastercard has more of its revenue coming from geographies where cards are still gaining share, not losing share.

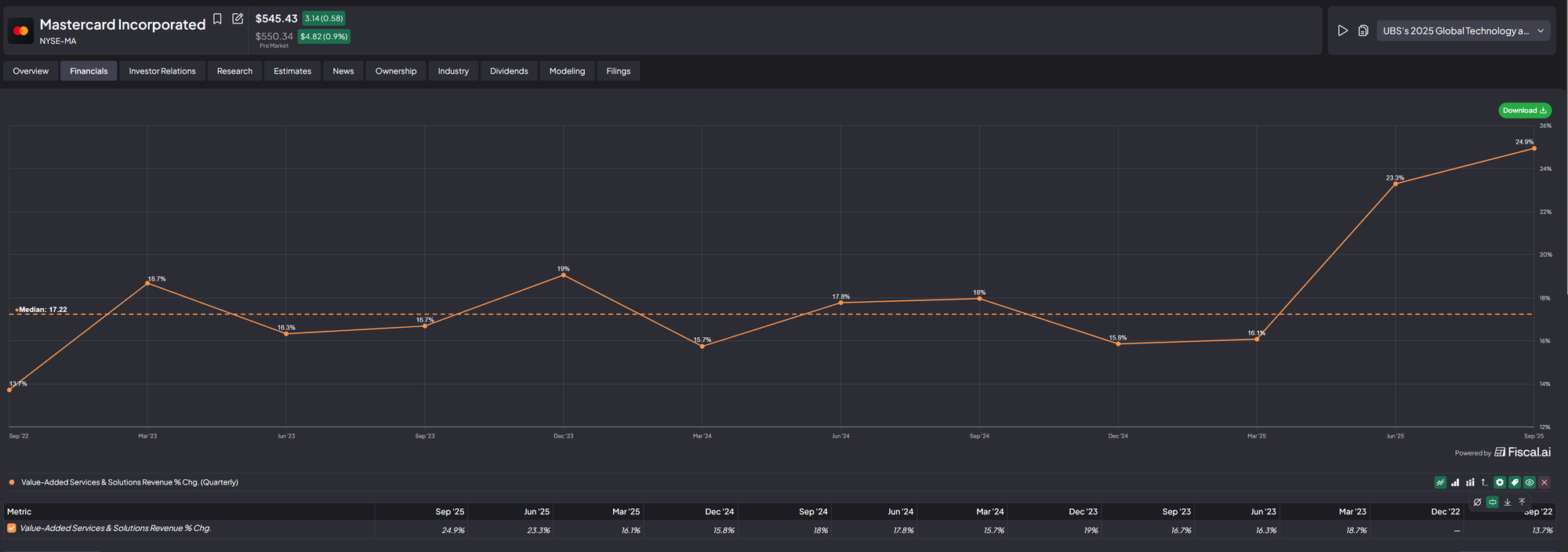

Value Added Services (VAS)

A second structural reason Mastercard is better positioned than Visa is the scale, maturity and profitability of its VAS portfolio outside of payment network income streams.

Mastercard’s VAS includes:

- Cybersecurity and anti-fraud tools

- Identity verification

- Data analytics and marketing platforms

- Consulting services for banks and governments

- Open Banking and account insights

- Loyalty, rewards, chargeback tools

This segment has grown at high-teens rates and now represents nearly 40 percent of Mastercard’s total revenue, higher than Visa’s 27 percent (Although Visa is growing fast at 24% YoY).

There are two benefits to Mastercard's higher VAS mix:

1. Hedge against payment-network regulation

If regulators compress card fees, VAS expands independently of interchange.

Many services (fraud prevention, tokenization, identity) even become more valuable in a lower-fee environment because merchants shift focus to risk and conversion optimization.

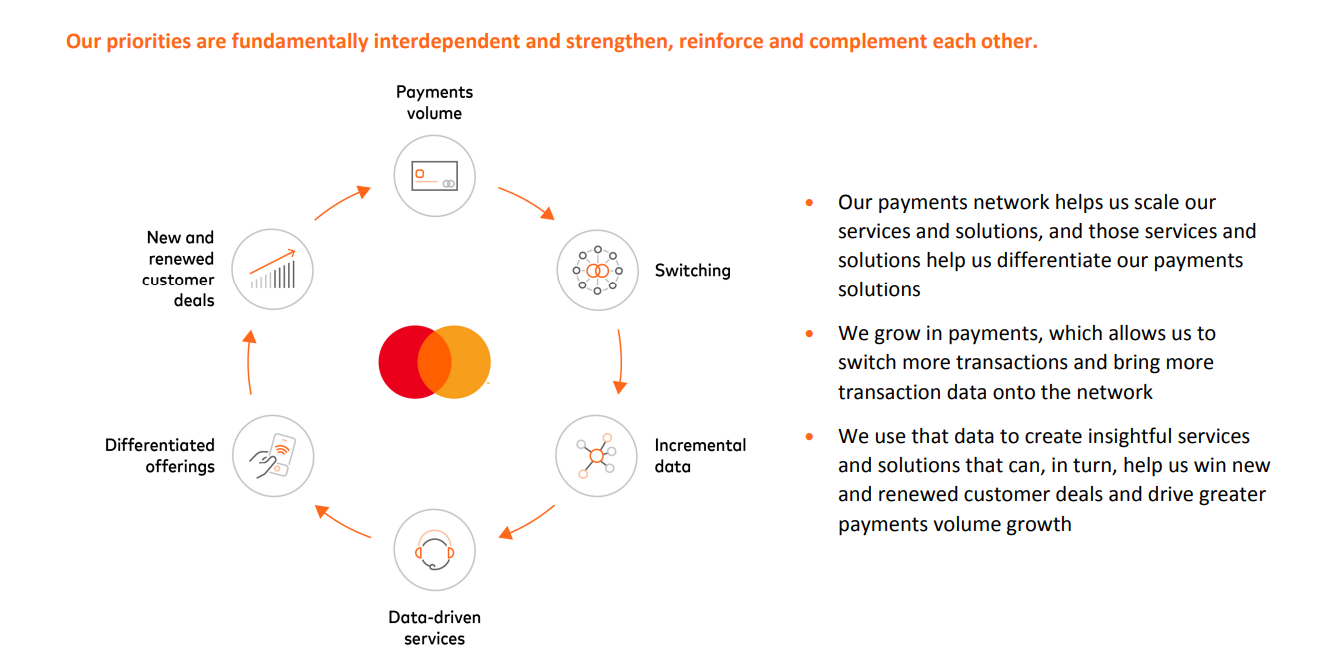

2. Commercial flywheel that strengthens the core network

To add, VAS is not a side-business, it is a deal-winning engine.

Mastercard uses data generated from its network to create VAS products which in turn helps Mastercard win:

- New issuer deals

- Network renewals

- Co-brand partnerships

- Government programs

- Digital wallet partnerships

Each contract win increases payment volume and switching transactions, which in turn feeds more data into the system.

This is a compounding mechanism Visa has been building, but Mastercard is meaningfully ahead in breadth and depth.

Mastercard is, in practical terms, the “Palantir of financial institutions” in the sense that VAS allows it to embed deeply within banks’ fraud, risk, loyalty, and analytics stacks. Visa’s capabilities are improving (e.g. Visa Consulting and Visa Risk + Identity solutions), but Mastercard holds the stronger position today.

In the next premium subscriber section, I cover,

- Why a potential buy opportunity may be coming up

- Valuation buy levels

- My specific portfolio next steps related to Mastercard & Visa

🔒Unlock the below with premium tier:

A Potential Opportunity?

Followers of my newsletter will know that I thrive on one strategy - waiting for