Trump-Venezuela Strike: My Portfolio Thoughts

Just yesterday, the USA launched airstrikes on Venezuela and captured President Nicolás Maduro in Operation Absolute Resolve. In this article, I share my investing thoughts following this incident as well as a key mental framework I use as a long-term investor.

US Market Implications

There are different takes I've heard as to why the US made this move such as,

- The Oil narrative, which is aligned with what Trump previously declared

- Critical metals and security concerns of Russia and Iran operating in Venezuela

But my favorite take is one where this swift take-down of Maduro was an indirect show of US military capability against the Chinese, especially following this earlier provocative post by the CCP and the fact that the Chinese delegation had just visited Maduro hours before the strike. More interestingly, Chinese-made defences failed to deflect the US attack in Venezuela, a sign that US military technology is still ahead of the pack.

So, perhaps it is safe to conclude Taiwan (given USA's protection) hence TSMC hence the AI narrative is likely safe from World War 3? Hahaha, nobody knows, and I shall stop here for fear of turning this newsletter into a geopolitical rumor mill.

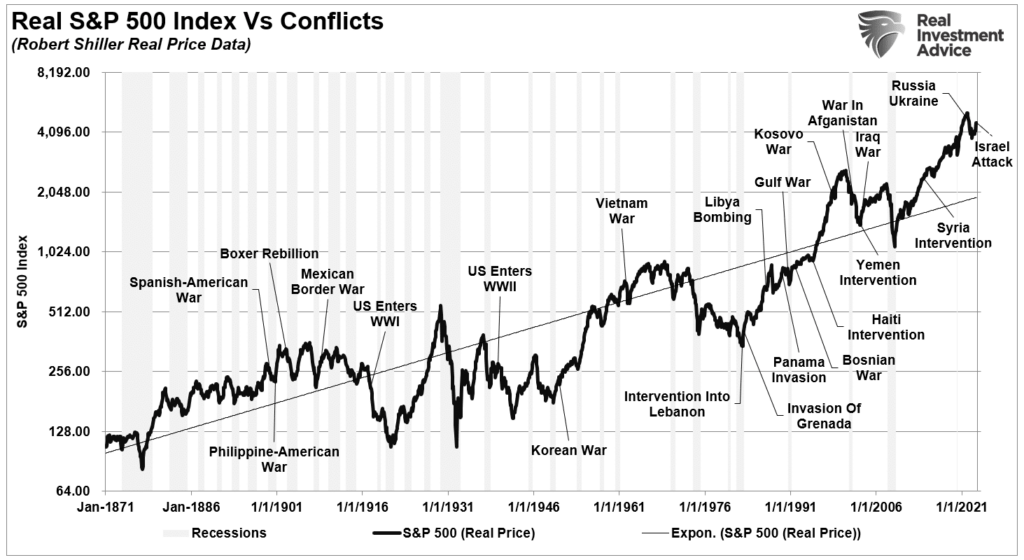

As a capital allocator, it's tempting to want to predict geopolitical events and which way the market will go tomorrow, since the entire strike was concluded in a weekend whilst markets were closed. The fortunate thing is I am no short-term trader but a long-term investor with more than a decade to go, and as history has shown below, wars have little impact on the long-term trajectory of the market.

Volatility Framework: Heads I win, Tails You lose

If you are a short-term trader, you would need to predict whether the market opens up or down tomorrow because your P&L depends on short-term predictions. Of course there are strategies one could play, regardless of direction, such as straddles, but again, a short term bet needs to be made - how sure are you there will always be volatility, especially given the fact that a Venezuela attack might have already been priced in?

As a long-term investor, whether the market opens up or down tomorrow, you win in both instances. This is a mental framework of "Heads I win, Tails you lose" and is one advantage a long-term investor always has compared to a short-term speculator. What do I mean by this?

A long-term investor sitting on a position (like myself with my portfolio and watchlist) may experience two likely scenarios tomorrow.

- Market crashes (Because Latin American uncertainty spills over to the US market)

- Market shoots up (Because the AI risk is reduced as mentioned earlier)

In scenario 1, if the market crashes (which I secretly hope it does), I get to deploy cash into high-quality companies that I've been waiting for on my watchlist, or to top-up existing positions like this one at specific value prices below intrinsic levels.

In scenario 2, if the market shoots up, I can simply enjoy the ride up on positions I already hold (or simply ignore what happens if the market goes sideways).

Can you see what I mean? In both scenarios, the outcome is positive for the long-term investor, because time is on your side, and all you need to have are,

- A high-quality set of companies that can survive long-term in-spite of short-term macro/geopolitical factors and continue to grow thereafter

- Patience and emotional resilience against fear

As long as you have the above, it no longer becomes a matter of if you can benefit, but more of when you profit. Of course, there are no definitive outcomes even with investing (sometimes fundamentals do get affected by certain news), but I prefer the odds and asymmetrical payoffs playing the long game than the short one.

Mercado Libre

One of the positions I hold in my portfolio and watchlist is Mercado Libre, a Latin American ecommerce and payments juggernaut, which I believe to be the strongest emerging markets company globally.

The following are my thoughts and potential portfolio actions with regards to this company for premium subscribers:

The first thing to pay attention to for Mercado Libre, in light of what happened in Venezuela, is...

See below: (🔒Unlock with premium tier):