Trump Greenland Portfolio Stance & January Earnings Season Stock Opportunities

In this article, I share briefly,

- My Investing Stance on Trump's Greenland Tariffs

- Stock Opportunities I'm looking for during this month's Earnings Season and my portfolio positioning going into Market Open tonight (🔒Unlock with premium tier:)

Greenland Tariffs

Over the last few days, Trump announced tariff threats towards the EU in light of the Greenland situation. Pre-market at the moment of writing, the S&P and QQQ are already starting to trail downwards in response to this situation.

My portfolio positioning and next steps this time is the same as my earlier article relating to Trump's Venezuela strikes just 2 weeks ago. I view Trump as the perfect volatility catalyst for good entry opportunities. The more tension he stirs, the more I capitalize on any high-quality companies coming down to juicy valuation levels on my watchlist.

I don't focus on analyzing or predicting short-term outcomes of geopolitical fallouts - this is a time-waster in my opinion, there are simply too many unknown variables and I am no political insider (even if I am, how can we account for the market's random reaction in the short-term?). I prefer to use the same amount of time to study businesses I'm interested in investing in or those I already own that I believe can withstand any form of geopolitical turmoil long-term. This is a method where one can have more control over with a more predictable outcome.

For pessimistic stock buys to work out, remember you need 3 main ingredients:

- The company has to be high-quality with a durable moat/USP/competitive advantage per this article in the first place. If it is a not a strong business, no matter how 'value' a price it falls to, the probability of an eventual rebound is low and even if it does rebound, there's a ceiling to how much compounding the company can have thereafter. The expected long term ROI out of such transactions in my view are generally poor. Per the words of Buffett, "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price"

- The right valuation buy level below the stock's intrinsic value (not just looking at the stock price alone!). There are many ways of valuing a stock such as DCF, Trailing/Forward valuation ratios (P/E, P/S, P/FCF), Sum of Parts, etc. Most of the time, I lean towards historical medians of trailing valuation ratios - I find there are too many unpredictable variables with methods that require multiple inputs such as DCF, especially with growth companies (my primary focus). There are exceptions of course depending on a case by case basis, but in general, I try to keep my valuation techniques simple and buy on pessimistic bad news. I list my valuation buy levels as well as the method I use in my watchlist.

- You need a long enough time horizon for the rebound to happen and the thesis to come into fruition - see this tweet on Chris Hohn's long-termism "Free Lunch". This could be days, months or even a short few years - nobody knows. In general, I hold judgement on whether any transaction I make is successful only after at least 5 years. For instance, if I make a stock purchase today, I will only conclude on 20th Jan 2031 whether or not today's stock purchase was the right move, by comparing the annualized CAGR earned out of said transaction vs the S&P500. (Services like Portseido can analyze this)

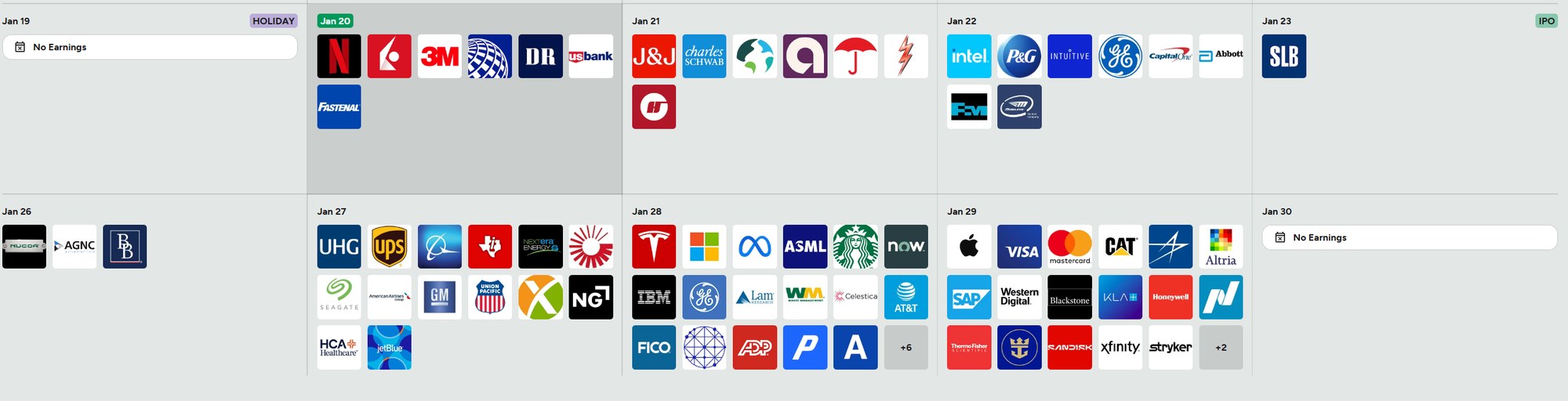

Below, I cover what I'm looking out for this Earnings Season in the month of January 2026 as well as specific companies and how I am positioning for tonight's market open (🔒Unlock the below with premium tier:):

Earnings Season and Moves going into Market Open Tonight (20th Jan 2026)

Several key companies will be reporting earnings this week and next (calendar above), the ones I will be paying more attention to and potentially making moves on are as follows...