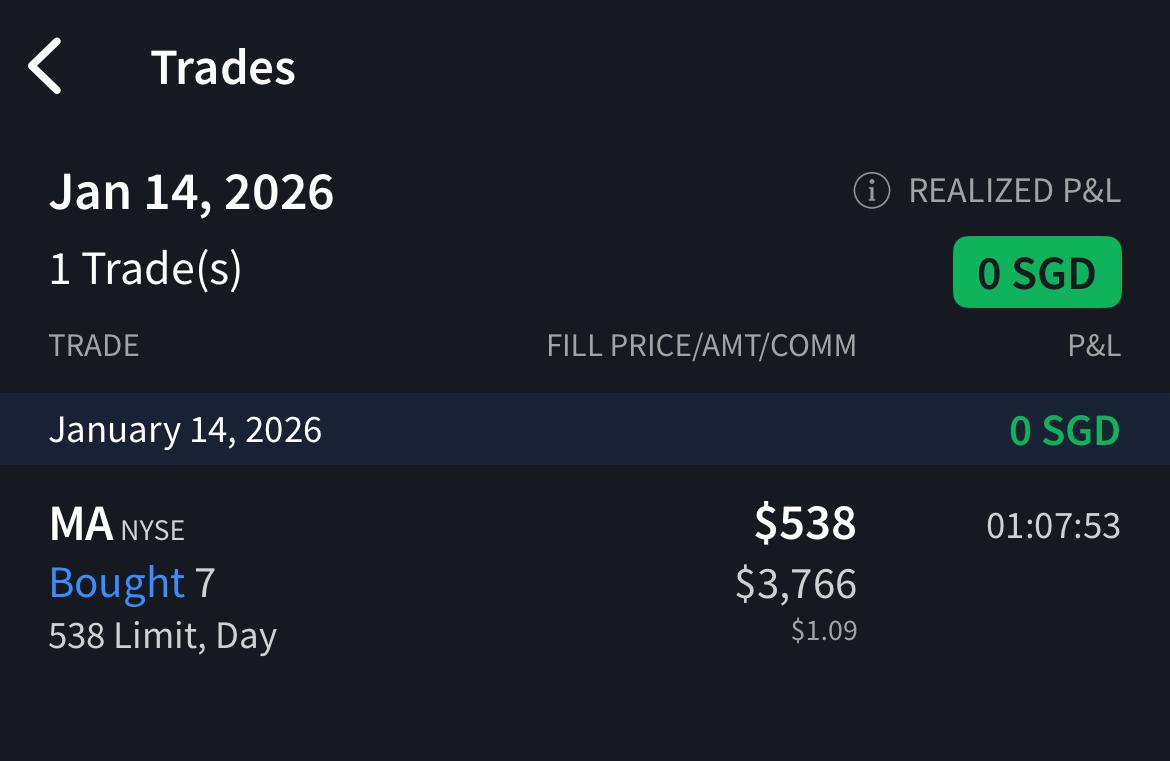

Transaction: 7 Shares purchased (USD3,766)

Disclaimer: Not a recommendation or advice to buy/sell any of the below mentioned stock/s. Only a transparent reveal of my own portfolio actions.

Transaction Made: 7 Shares of $MA bought at USD538

I typically send transaction emails like this only to premium subscribers, but I thought this transaction is quite a symbolic milestone in my portfolio and I wanted to share it with everyone (including free subscribers). After years of investing, I finally got an optimal chance to initiate my 6th position, Mastercard, following my thesis in this earlier article.

For context, I run a concentrated portfolio of 5 high conviction names and am only able to add new stocks from my watchlist when opportunity cost of allocating incremental capital is unusually low. In practice, this means I always prioritize adding to existing positions, and any new idea must compete directly with current holdings for capital allocation. Over the past several years, that bar was rarely met for Mastercard. Periods when Mastercard traded at a pessimistic valuation almost always coincided with similarly attractive or superior opportunities within my existing portfolio, which made reallocating capital difficult to justify.

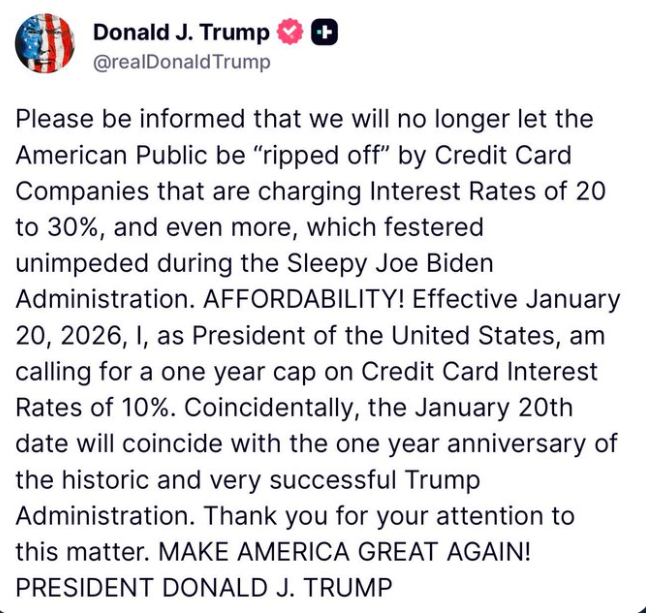

Mastercard has traded below its historical 5 yr median trailing P/FCF (See below) for a while but I wanted to wait for pessimism to hit the stock before making a move and good old Trump has given me an opportunity with the recently announced 10% interest rate cap on credit cards.

By now, you should be familiar with my modus operandi, I typically wait for 2 things to happen before buying a stock on my watchlist on any given day,

- A strong intra-day price action drop

- Accompanied by unjustified pessimism specific to the company (e.g. "bad news" which I believe the market has misunderstood)

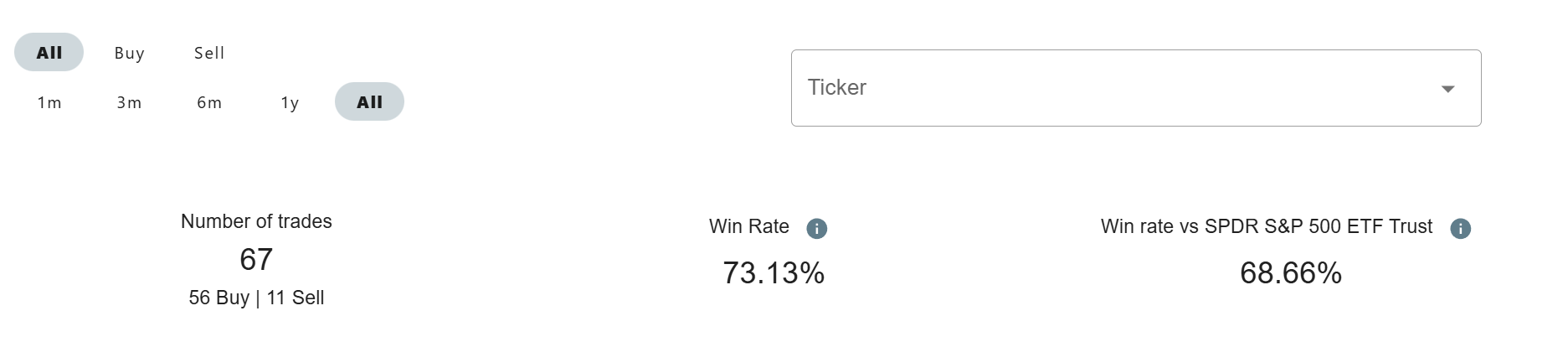

So far, this method of buying (assuming the company is high-quality and durable long-term with a moat/USP), has yielded great success, yielding me a transaction win rate of 68.66% compared to the S&P500 out of 67 trades I've made since I started investing years ago.

Note that this transaction is a 'nibble' instead of my usual fat pitch, because I have a bit more spare capital that I am reserving for 2 purposes,

- Further averaging down Mastercard if it goes lower, because my original watchlist buy level is still ways to go (possible, given the volatility surrounding the industry now after the trump announcement)

- Or, allocating the capital to Netflix should it hit my lower desired valuation price level as stated in this earlier article

Should both stocks go up (this is not something I can predict short-term), I am ok not to deploy any additional capital.

What about Trump's 10% Interest Rate Cap?

The first thing to understand is that Mastercard and Visa are payment network companies, not credit card issuers. Credit cards are issued by banks such as JPMorgan Chase or by closed-loop issuers like American Express. The proposed 10% cap applies to credit card interest rates (APR), which are earned by card-issuing banks, not by Visa or Mastercard. Visa and Mastercard generate revenue primarily from network and processing fees charged per transaction, and they do not earn interest income.

There may, of course, be second-order effects. If an interest-rate cap reduces banks’ ability to price for credit risk, issuers may tighten underwriting standards and reduce exposure to higher-risk consumers. That could lower the total number of transactions processed by the Visa and Mastercard networks. However, the opposite outcome is also plausible. Lower interest rates could increase consumer spending and card usage, which would increase transaction volumes and, in turn, network fee revenue.

Secondly, JPMorgan (and I'm sure the wider banking industry soon) has announced that they would fight tooth and nail against this. Furthermore, interest-rate or card-fee caps have a poor historical track record of being implemented in the United States:

- Last year, Senator Bernie Sanders introduced a similar bill to temporarily cap credit card annual percentage rates at 10% but this never advanced into law.

- Under the Biden Administration, the Consumer Financial Protection Bureau (CFPB) finalized a rule to cap credit card late fees at $8 for large issuers, but this cap was thrown out and was never implemented

That said, I subscribe to the principle of "never say never". Trump has shown a willingness to pursue disruptive policy positions as we've seen with Venezuela, and he could well have stronger political will to push this rate cap through (to which I am prepared to average down in such a scenario that would likely create more volatility - I half hope this happens btw, it's rare to get Mastercard at incredible bargain prices).

Ultimately, the only way network revenue decreases is if overall consumer spend goes down as a consequence of this fee cap and politically, I don't think it is in President Trump's interest for consumer spending to go down, since the USA is very much a consumer based economy.

In conclusion, I view the 10% APR cap announcement as a nothing burger. It does not alter my long-term thesis, and I expect to hold Mastercard for a decade or longer.