The only China Stock I'm investing in

Note: This is usually a paid premium tier article from Stock Research Vault but I am releasing this issue for free. At the end of this article, I outline my valuation buy levels and next moves with this stock. Btw, I am neither American nor Mainland Chinese so you can discount patriotic bias. I am but a turtle capitalist)

For those of you who follow me on X/Twitter, you’ll know that most of my investments are US-centric, and I’ve actively avoided China exposure for years. It may come as a surprise that I’m now writing about investing in what I believe is the only Chinese company that makes sense, let me explain what changed my mind.

Some context: back in 2021, I initiated a sizable 20% position in the MSCI China ETF (MCHI), which tracks large and mid-cap companies across the country. Within weeks of doing so, the government issued sweeping rules banning for-profit tutoring.

Chinese educational stocks, TAL & EDU, fell as much as 90% from historical highs. The stocks have barely recovered 4 years later.

This followed Jack Ma's downfall with Alibaba and I realized I had made a crucial mistake - in China, political risk can override even the most compelling fundamentals.

I exited all my Chinese positions within months, absorbed a ~25% loss, and reallocated the remaining capital into U.S. Big Tech. That pivot proved profitable, compounding at ~20% CAGR despite the 2022 Fed-driven crash. I never looked back at China after that; I simply had no edge in quantifying government risk.

In recent years, however, I began travelling to China more frequently as a Solutions Engineer for a North American tech company. Across 8 visits (most recently last week) and years of working with Chinese counterparts (yes, I speak business-level Mandarin), I noticed an interesting pattern.

There is one app so deeply embedded into daily Chinese life that replacing it is nearly impossible, even under significant regulatory threat.

That app is WeChat.

And the company behind it is Tencent (Ticker: HKG: 00700)

Now, instead of starting with the financials like every other analyst, I’m going to approach my thesis on Tencent from a completely different angle. I'll share real, on-the-ground observations from years of travelling to China and working with Chinese counterparts. These anecdotes illustrate why WeChat is so deeply intertwined with daily life that one could argue the government relies on it more than the other way around.

This anecdotal approach ties back to my 2nd major criterion for identifying high-quality compounders (the 1st being circle of competence) - a unique and nearly impossible-to-replicate business moat. If a company fails this test, I usually don't bother proceeding to the next qualifying step and add it to my "Not-for-me" investing pile, much like Munger's process of inversion.

Let's begin with Corporate communication culture in China.

Having worked in Australian, EU, and now U.S. tech companies, the default communication channels are email, Slack, or Microsoft Teams. When I first interacted with Chinese counterparts over email, I was met with disappointment, received little response or single-sentence replies such as: “可以加微信吗?” (“Can I add you on WeChat?”). It took me a while to realize that email is culturally perceived as slow, impersonal, and inefficient in China. Instant messaging on WeChat or WeCom (the enterprise version) is seen as faster, more respectful, and more service-oriented.

After multiple failed attempts to reach out with a “Western” communication style, I eventually adapted. Today, I’m in dozens of WeChat work groups, and the expectation is clear: WeChat sits at the core of most workplace communication in China. Alternatives like DingTalk (Alibaba) or Feishu (ByteDance) do exist, but they lack the social, non-work ecosystem that WeChat seamlessly blends alongside professional messaging, making them far less pervasive outside the office.

This dynamic extends offline as well. At business conferences, physical name cards are practically extinct. The standard greeting after a conversation is again “可以加微信吗?”. Nearly everyone in China carries WeChat as part of their daily life, but not everyone uses DingTalk or Feishu, making WeChat the universal default in the country.

Event delegates typically scan each other’s WeChat QR codes and instantly exchange contacts (see image below). I’ll admit - on multiple occasions, I pretended to add someone after scanning their QR code because I suspected they were about to recruit me as personal tech support 🤡.

Exchanging WeChat contacts naturally strengthens business follow-up probability because it shifts the relationship into a more personal channel. In China, business conversations don’t live inside rigid corporate confines; they often spill over into a more personal space - think late-night messages or casual voice notes (语音). Personal WeChat makes it easy to continue momentum outside formal office hours, which is often where trust is built and deals are truly made. Work-only platforms like DingTalk or Feishu feel transactional, while personal WeChat carries an implicit layer of familiarity and accessibility - two traits that map closely to how Chinese business relationships develop.

Day-to-day dining at restaurants showcases one of the stickiest WeChat features. On my first business trip to China, I recall sitting down at a restaurant, ready to order. I spotted a QR code on the table, instinctively pulled out my iPhone, and scanned it with the native camera - just like how QR ordering works in most countries.

To my surprise, the IOS camera could not parse the QR and the restaurant staff prompted me to use WeChat instead. The only 2 other apps that are usually supported are Meituan's Dianping app or Alipay. However, not all restaurants in China offer a Dianping/Alipay QR, but every restaurant that offers QR is WeChat-enabled. Whatever the reasons are, it is incredibly difficult for all restaurants in China to switch away because their restaurant backend systems are already tightly integrated with WeChat's 小程序 (Mini apps) ecosystem.

If you thought that was the end of WeChat's reach, almost every ticketed attraction in China requires scanning WeChat QR at the entrance to purchase tickets before entering. There were even some instances I could not enter a ticketed venue because my WeChat was malfunctioning (They couldn't even take cash on the spot!). For most ticketed entries, WeChat is the default, and I haven't yet encountered other alternatives (Alipay/Dianping).

The dependency goes deeper. Major membership systems (e.g. Starbucks), retail loyalty programs, mall promotions, and even hotel concierge services all route to WeChat Mini Programs.

Below is an actual WeChat conversation I had with hotel staff after scanning the in-room’s QR code - room service, housekeeping, amenities, all requested digitally.

Of course, beyond work and commerce, WeChat is the default social communication app between friends and family in China. Countless private messages, photos, videos, voice notes, and social moments are exchanged daily and switching costs are immense - it’s where people live their digital lives.

At this point, it’s worth pausing and asking the 80/20 question: based on the anecdotes above, is WeChat, owned by Tencent, so deeply embedded into Chinese society that even the government would be reluctant to threaten its existence the way it did with private education (TAL & EDU)?

In my view, the answer is a resounding yes.

Furthermore, Tencent’s founder, Pony Ma, has never publicly challenged regulators the way Jack Ma did before Ant Group’s failed IPO. Governance risk is always present in China, but Tencent historically plays by the rules - reducing the likelihood of an existential regulatory surprise.

This leads naturally to the next question: why Tencent, and not other Chinese companies?

The key, once again, lies in substitutability. If the government banned a particular service, how easily could the market shift to alternatives?

Here’s a theoretical mapping of substitutes if certain companies disappeared tomorrow due to regulatory action:

Payments: Alipay ↔ UnionPay (rails) ↔ WeChat Pay

Food Delivery: Meituan Dianping ↔ Ele.me (Alibaba) ↔ JD Waimai

Social Reviews / Discovery: Meituan Dianping ↔ AMap (Alibaba) ↔ Xiaohongshu (RED) ↔ Douyin

E-commerce: Taobao ↔ JD.com ↔ Pinduoduo ↔ Douyin/TikTok commerce

Cloud: Alibaba Cloud ↔ Baidu Cloud ↔ Tencent Cloud

Work Messaging: DingTalk ↔ Feishu ↔ WeCom / WeChat

Logistics: SF Express ↔ JD Logistics ↔ Cainiao

Maps: AMap ↔ Baidu Maps ↔ Tencent Maps ↔ Apple Maps

Electric Vehicles: BYD ↔ Geely ↔ Huawei ↔ foreign brands like Tesla (if permitted)

Social Messaging + Network + Mini Program ecosystem: WeChat ↔ ??? (Alibaba only covers portions of mini apps & payments, not the social graph or messaging layer)

Replacing any of the alternatives listed above would certainly be painful, but none carry the same level of social systemic risk as removing WeChat. In China, societal harmony takes precedence over financial ramifications. Huarong Asset Management proved that even a state-linked financial powerhouse can be allowed to wobble, for as long as social disruption is minimized.

I also did a fun exercise by interviewing a no. of local Mainland Chinese and asked a theoretical question: if every app on their phone disappeared except one, which would they keep? The response was unanimous: WeChat. Alipay consistently placed #2, but when forced to choose only one, everyone reasoned that WeChat could still replicate most of Alipay’s core payment functions - whereas no other platform could replace WeChat’s blend of communication, identity, social graph, and services.

And so WeChat clears my first and most important investment calculus in China - irreplaceability and social systemic importance.

With that established, now it becomes meaningful to dive into,

Business model and financials:

Tencent reports revenue across four primary business segments. As of Q2’25, the breakdown is approximately:

Value-added Services (VAS) ~50%

- Online games ~32.5%

- Social Network ~17.5%

- FinTech and Business Services ~30%

- Marketing Services (Online advertising) ~20%

- Others ~ <1%

The most important pillar of my Tencent thesis, WeChat, contributes meaningfully through multiple revenue streams:

- Marketing Services (Online advertising) ~ 20% of total revenues

- Includes WeChat Moment Ads, Video Account Ads, Mini Program Ads, Search Ads and more

- FinTech and Business Services ~ 30% of total revenues.

- This segment bundles both WeChat Pay (FinTech) and Tencent Cloud (Business Services). While Tencent doesn’t disclose a granular split, given its ubiquity across all the touchpoints I mentioned earlier which lead to payments, we can assume at least ~80% of this segment comprises FinTech. That implies roughly ~24% of Tencent’s total revenue is driven by WeChat Pay alone.

Putting these together, WeChat can be reasonably attributed to ~44% of Tencent’s total revenue - possibly the single most important component of the company’s financial engine.

Beyond WeChat, Tencent is also the second-largest gaming company in the world by revenue (after Sony). Its portfolio includes full ownership or substantial stakes in premier studios and IP such as:

- Riot Games (League of Legends, Valorant)

- Epic Games (Fortnite, Unreal Engine)

- Supercell (Clash of Clans, Clash Royale)

…and many more.

Zooming out, examining Tencent’s investment portfolio (see this spreadsheet, also credit to Compounder fund's thesis) reveals a sprawling empire. Through strategic equity stakes, it holds meaningful positions in JD.com, Pinduoduo, and Meituan, among others - further solidifying its “too big to fail” profile within China’s consumer and digital economy.

With that foundation, let’s now walk through my multi-step framework for identifying high-quality companies.

Unique Selling Proposition/ Moat/ Competitive Advantage:

WeChat clears this bar with ease. Its irreplaceable position in Chinese social, professional, payments, and day-to-day life creates a competitive shield unlikely to be shattered by regulatory risk without broad societal disruption.

One of the simplest financial lens to quantify competitive advantage is pricing power, often visible through gross margins. Over the last decade, Tencent has maintained a median gross margin of ~48%, and in recent years has re-accelerated toward ~55%. For a business of Tencent’s scale and product breadth, that level of margin durability signals meaningful pricing power and operational leverage - both hallmarks of a strong moat.

Let's move on.

Secular trends Tencent rides

Tencent also benefits from several long-duration tailwinds across its core business lines:

Online Gaming: According to Newzoo, the global online gaming market is projected to grow at a 3% CAGR, reaching USD 206.5B by 2028. Tencent’s gaming division is currently generating an annualized run-rate of roughly USD 33B as of Q2’25 - approximately a 16% share of the global market with more room to grow.

Mobile Payments: China's Mobile payments in China is expected to grow at ~21.8% CAGR from 2026 - 2032, reaching USD48Bn by 2032 according to this report, where WeChat Pay has ~42% market share compared to AliPay at ~53%. With WeChat Pay’s oligopolistic market position and distribution advantage, this segment should continue compounding as cashless behavior deepens.

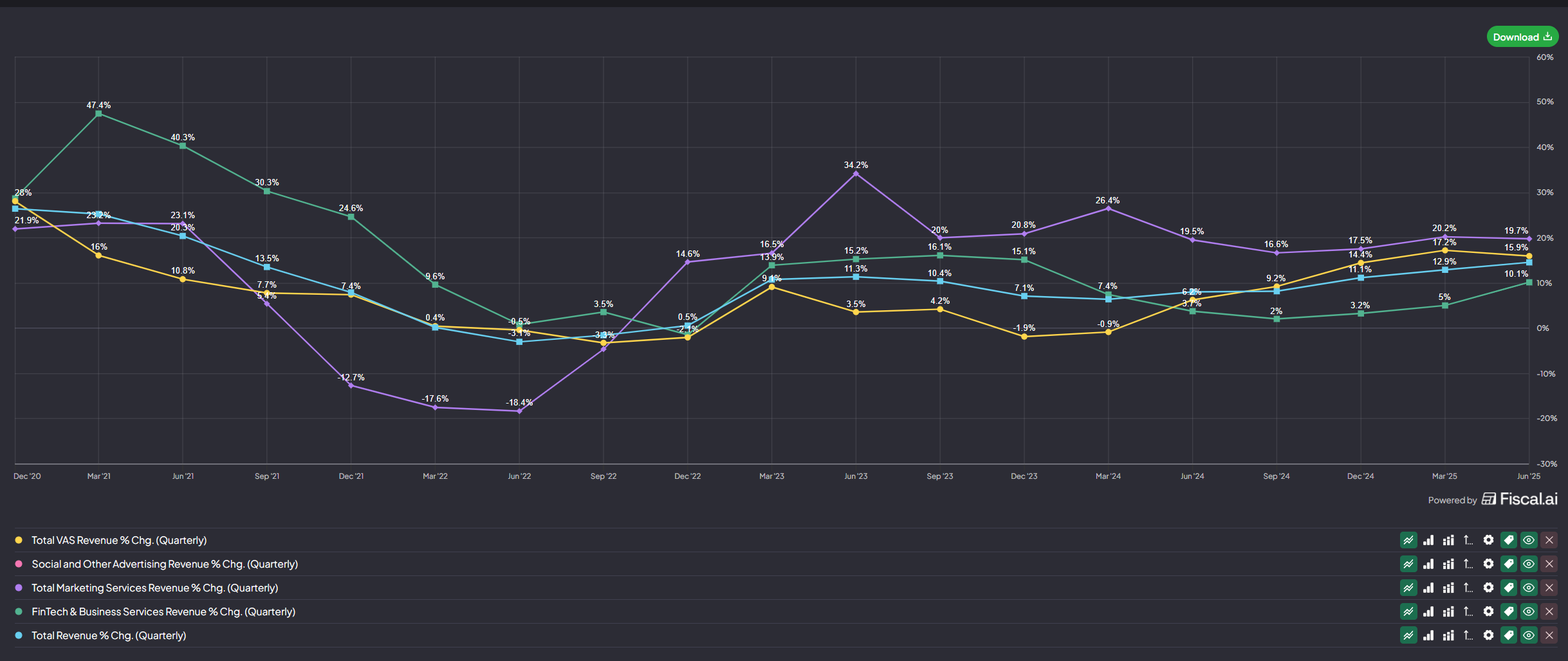

Digital Advertising: Advertising momentum is accelerating across Tencent’s surfaces, particularly within WeChat Moments, Video Accounts, Mini Programs, and Search. China’s digital advertising market is projected to grow ~7% CAGR over the next decade, and Tencent’s marketing services segment has recently printed high-teens to ~20% YoY growth (see purple line in diagram below), constituting the fastest growing segment in the last no. of quarters.

Consistently growing revenues/ profits/ cashflows

Over the last decade, Tencent has steadily grown top-line revenues (see blue bars below), and in recent quarters has re-accelerated to ~14.5% YoY growth in Q2’25.

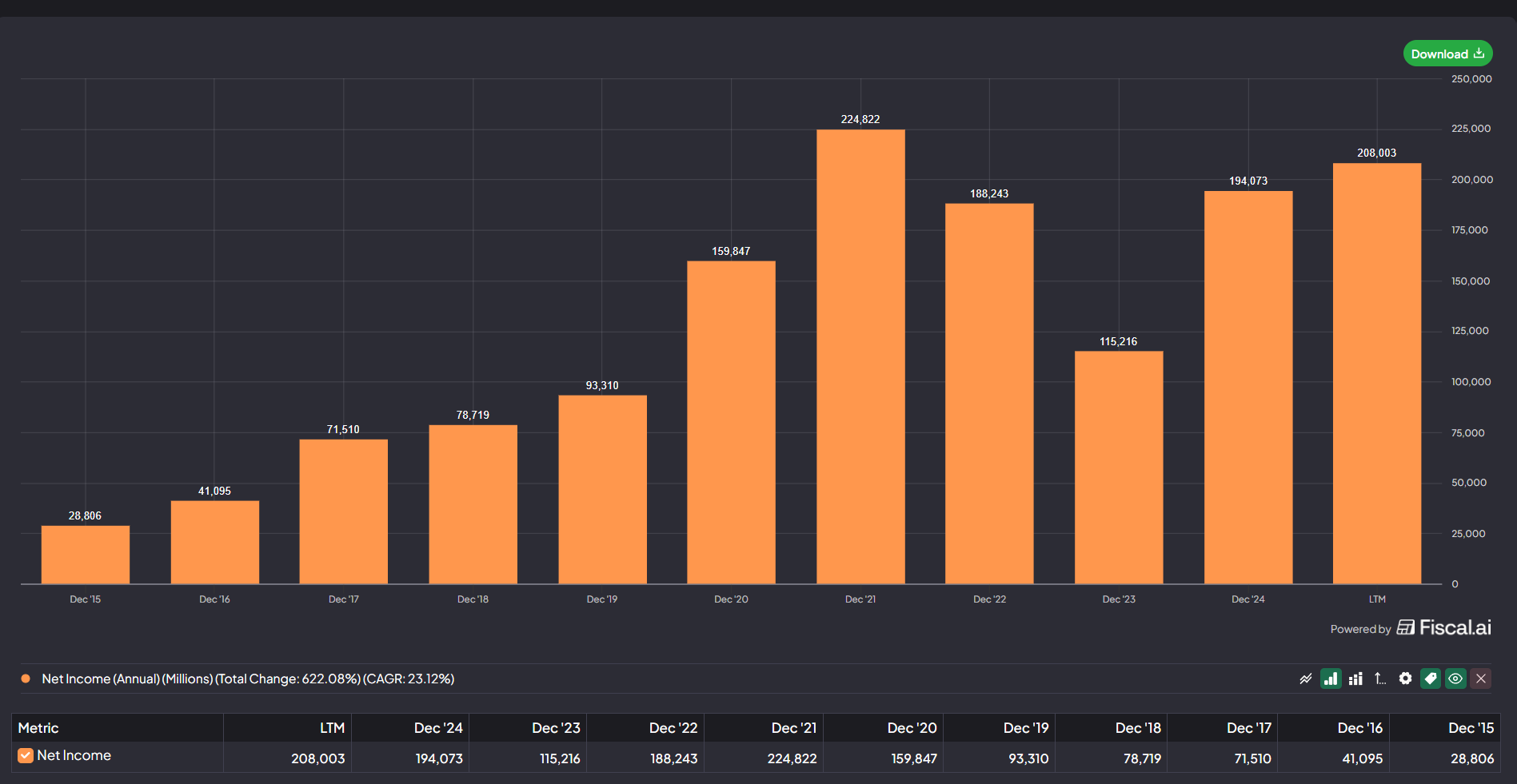

Net profits grew consistently as well except for '22 - '23 when a combination of the pandemic and tightened regulations on gaming hit Tencent's bottomline (see below yellow bars)

Most importantly, Tencent has delivered consistently growing operating and free cash flows with FCF margins at a median of 33 over the past ten years (see chart below).

The share count has also been decreasing over the past decade, so shareholder dilution is not an issue with Tencent.

In general, Tencent passes my vibe check for consistent financials over a long period of 10 years, apart from the odd 1-2 years owing to the pandemic and gaming regulation.

Management

Tencent was founded in 1998 by Ma Huateng (better known as Pony Ma), who continues to serve as Chairman and CEO at age 54

Skin in game:

Pony Ma currently owns approximately 7.85% of Tencent’s outstanding shares, valued at roughly USD 57.2B as of 4 November 2025's closing price. Forbes estimates his total net worth at USD 64.7B, meaning about 88% of his personal wealth is tied directly to Tencent shares!

This level of ownership concentration is uncommon among founders of companies at Tencent’s scale (Only Zuckerberg comes to mind). It creates strong alignment with shareholders: if Tencent’s value declines, he bears the majority of the financial impact personally. I'm confident of Pony Ma's deep incentives to ensure Tencent continues compounding value over the long term.

Soul in game:

Pony Ma is famously private and unassuming, so it took some digging to understand why he continues to lead Tencent despite being the 29th-richest person on the planet. Put differently: what motivates someone who no longer needs another dollar?

At a 2011 fireside chat at Disrupt Beijing, Pony remarked that “wealth won’t give you satisfaction; creating a good product that’s well received by users is what matters most”. That ethos echoes through Tencent’s most important product leader, Allen Zhang, the architect of WeChat, who in a widely circulated 2019 talk, criticized KPI-driven product thinking: “PMs in many industries are misled by their companies… everyone’s job is not to create the best products, but to use all means possible to acquire traffic. We don’t support this way.”

Both leaders, aligned in philosophy, share an almost craftsman-like pride: build the best possible product that's truly useful for the user as opposed to meeting internal targets. I think this sense of pride and personal drive is what continues to drive both Pony and his team in continuing to run the most valuable company in China.

Risks

- Ownership structure - Tencent uses a VIE (Variable Interest Entity) structure where Tencent shareholders do not own the China business directly, but instead own entities in the Cayman islands that receive financial benefits from the China business through contracts. If the government decides to nullify these contracts, investors could face a wipeout on capital! Unlikely to happen, because the economic fallout for China would be disastrous, but still, something to take note of.

- Regulatory risk - This is always an issue as with all Chinese companies. The key here is how severe the repercussion gets. Tencent does get the occasional regulatory crackdown such as tightening of gaming or fines.

Portfolio View & My Next Investment Steps:

Note: The following does not constitute financial advice/recommendations and is merely a journal of my own portfolio investment actions.

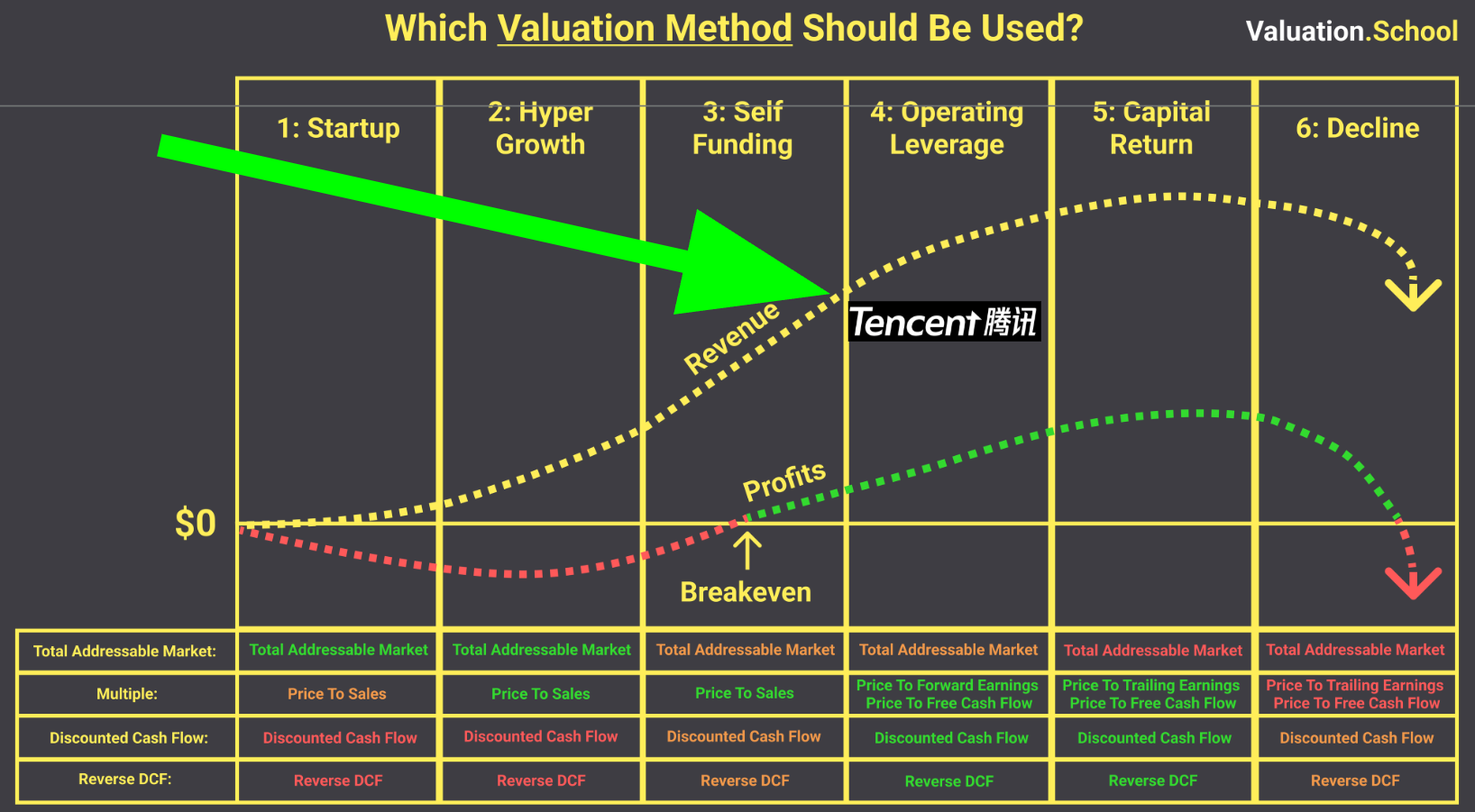

Although Tencent's crown jewel, WeChat, has a competitive moat which I believe is virtually irreplaceable and revenue that's re-accelerating and likely to reach somewhere in the high teens in the coming quarters, I am placing it in phase 4 (See diagram below), as a "Stalwart". Tencent's growth trajectory is unlike some of the other more explosive growth stocks in my portfolio which are in earlier phases of growth because,

- I don't see Tencent expanding much more than China + the Chinese overseas diaspora so there's a theoretical ceiling to how much it can grow (I doubt the rest of the world, who have no familial/friend links to Mainland China, will be using WeChat as the main app or payment method long term).

- I don’t feel like there's an unpriced, exponential growth optionality emerging on the horizon. Tencent’s value creation will likely continue to “chug along” through its existing pillars - WeChat’s ecosystem, gaming, advertising and cloud - but without the speculative upside optionality that can materially re-rate the business.

As with all phase 4 companies, I have a certain way of valuing such a business.

The timing of this analysis is pretty apt for me, since they are due to report earnings on 13th November 2025 in about a week's time, so volatility pre/post earnings could present opportunities to my liking.

I have updated my buy levels and corresponding next moves regarding Tencent stock as follows below: (🔒Unlock with premium tier):