Netflix Q4 2025 Earnings & follow-up portfolio actions

In the earlier transaction post and earnings season article, I laid out my plans for $NFLX pre and post earnings. Premium Subscribers would have gotten an email notification of my transaction moves last night pre-earnings.

In this article, I cover

- Netflix's Latest Q4 2025 Earnings Analysis

- Growth Catalysts on $NFLX and my next moves with the stock in my portfolio (Premium Subscribers)

Netflix Earnings Analysis

Here's a quick lowdown on the key metrics reported (Quarterly YoY values below)

Revenue: $12.05B (vs Analyst Est. $12B), +18% YoY

Diluted EPS: $0.56 (vs Analyst Est. $0.55), +33.7% YoY

Operating Income: +30.1%

Operating Margin: +10.6%

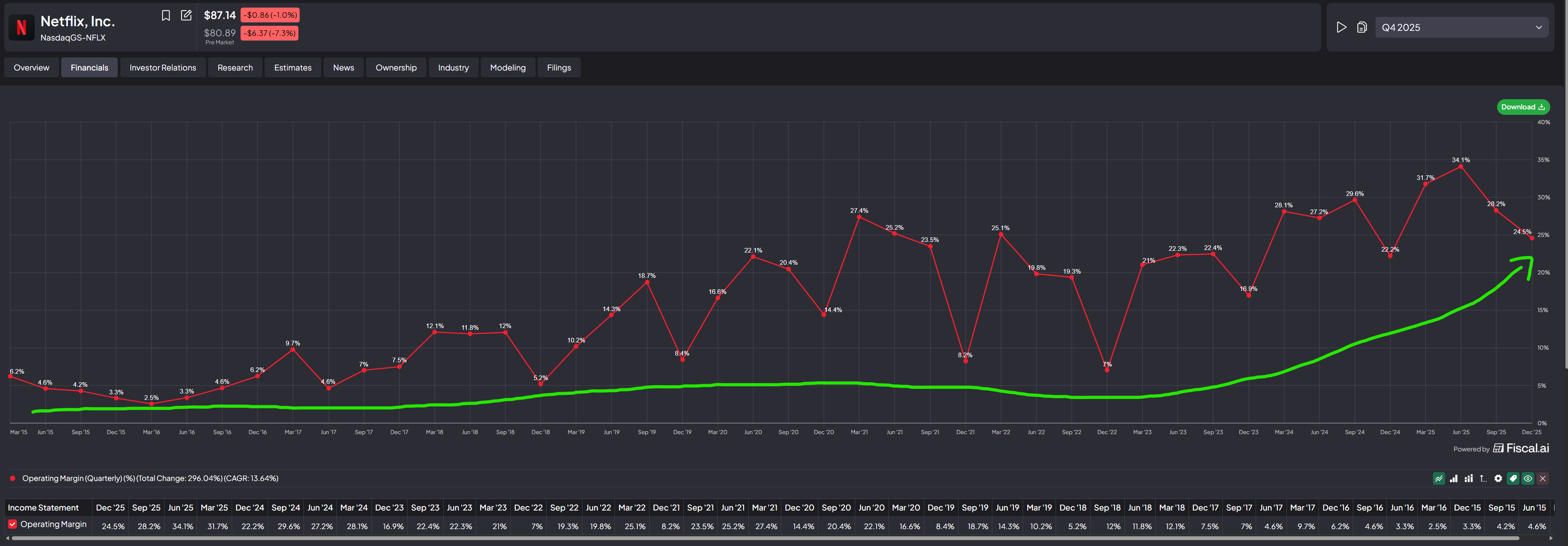

Although Revenue and EPS exceeded analyst estimates by just a little, I thought it was a good sign that the quarter carries on the long-term trend of operating margins sloping upwards over time - a sign of increasing operating leverage (See chart below over last 10 years).

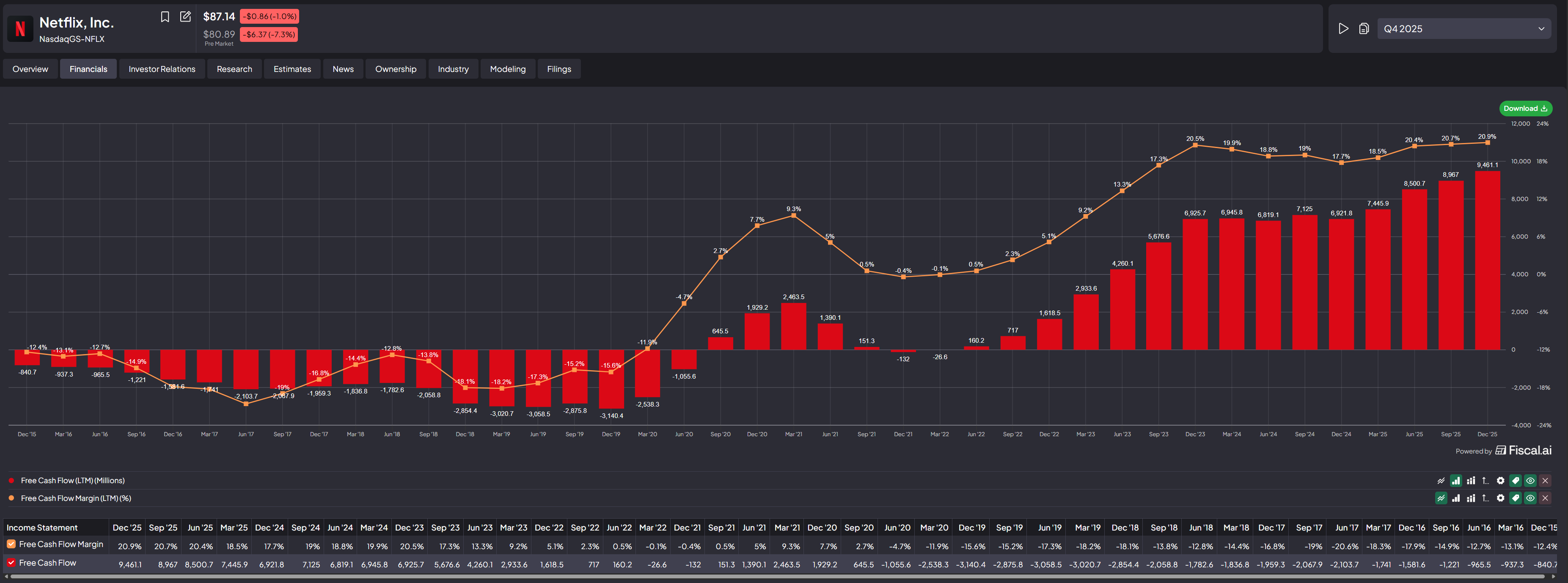

It was also nice to see confirmation on the Free Cashflow side of things, with FCF +36% YoY and on a Trailing 12 month basis, both FCF and FCF margins are trending very nicely upwards over the last 10 years(see diagram below).

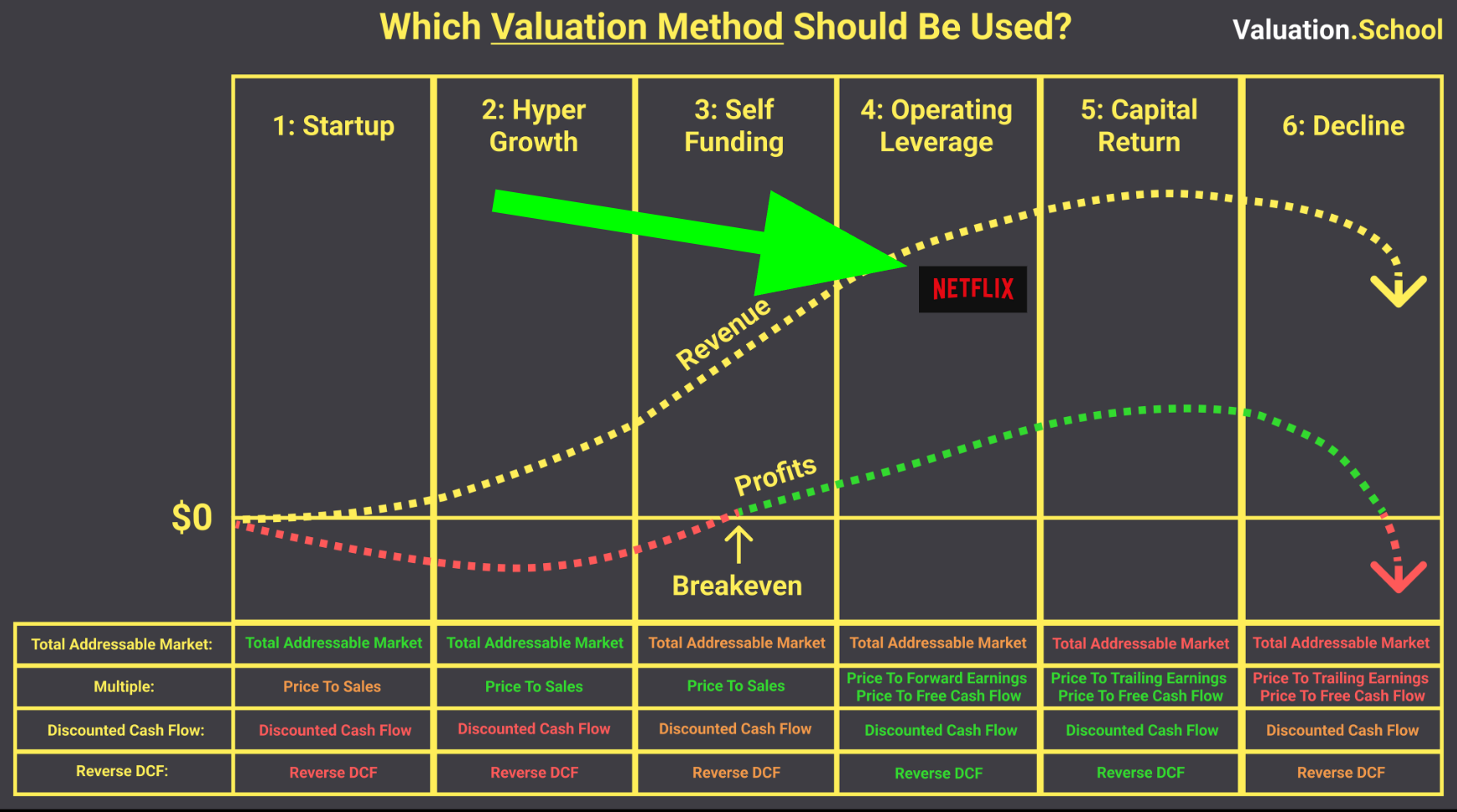

This company has come a long way and in my opinion, is no longer a speculative company, but a far more stable compounder that is exercising Operating Leverage (Diagram below).

Subscribers

With Management's increasing focus towards advertising and total revenue, they no longer report paid subscribers consistently. However, management did reveal this time, that subs crossed 325M this Q4 2025.

I'd like everyone to take a pause on this for awhile. Remember in 2022 when the stock dipped -35% when the company lost 200K - 1Million subscribers for the first time? Since then nearly 4 years later, Netflix has added over 100 Million Subscribers and its share price has compounded to ~USD85 as of the time of this writing from a low of USD16, a +422% increase. Let that sink in on the power of long termism!

So why did the stock price fall?

With reported metrics being generally positive, why did the stock price still fall post-earnings release?

It could be,

- Uneasiness over the Warner Brothers deal that is adding a lot of debt to Netflix's balance sheet

- Revenue and EPS beats not impressive enough and EPS likely to be affected in the short-medium term since management has stated they aren't buying back shares at these prices and are reserving cash to serve the WBD deal

- Technical reasons

The truth is nobody knows! In times like this where financials are positive and I don't spot any anomalies yet the stock still dips, I don't spend too much time on uncovering the real reason! The key question I ask myself is, will the business be stronger 5 - 10 years from now fundamentally?

The answer to this question, along with my valuation buy level/next steps are included in the next section below:

Growth Catalysts I'm looking at

There are 3 growth catalysts I'm looking at for Netflix,

Catalyst 1:

During the earnings call, Co-CEO Greg Peters pointed out a particular part of the business that is growing incredibly fast. The business segment is...

🔒Unlock the below with premium tier: