Netflix buys Warner Bros: Trap or Opportunity for Growth Investors?

On 5 December 2025, Netflix announced its acquisition of Warner Bros. Discovery (WBD). Just three days later, Paramount Skydance, led by CEO David Ellison, son of Oracle founder Larry Ellison, launched a hostile takeover bid for WBD.

Coming shortly after Netflix’s Q3 earnings, where a Brazil-related tax impact pressured results, the evolving WBD situation has further weighed on Netflix and it is now down -30% from its 52-week high.

For long-term growth investors, this raises a question.

Is Netflix’s acquisition of WBD long-term value accretive or value destructive?

In this article, I cover:

- The 3-Way deal & Potential Outcomes

- My Investing take on this situation and Netflix's Future

- My buy levels and portfolio next move for Netflix, including a valuation-driven framework informed by specific past drawdown events

The 3-Way Deal & Potential Outcomes:

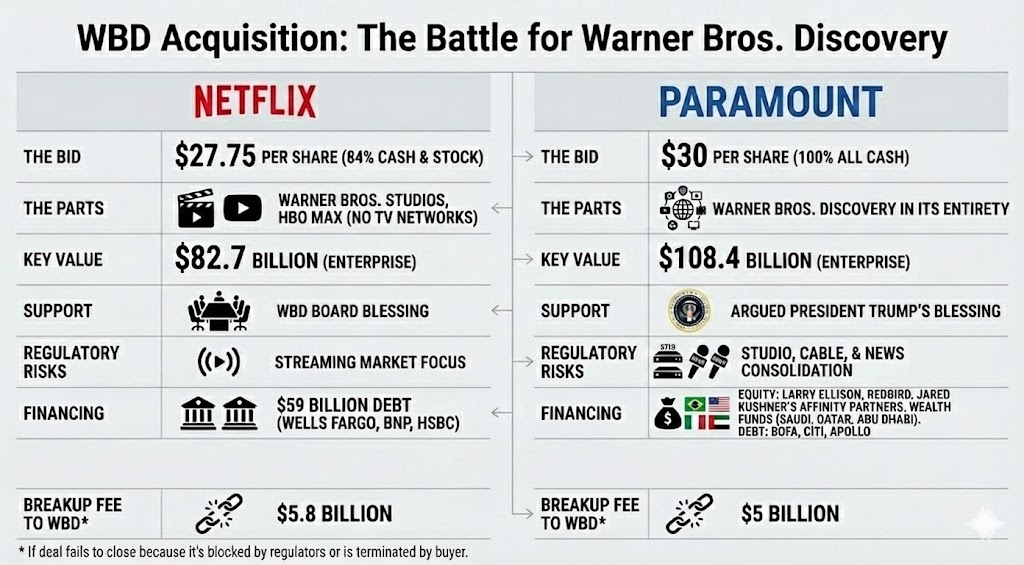

The above infographic summarizes the difference in bids. There are 3 potential outcomes I believe can happen.

Outcome 1: Netflix completes the deal (Highest chance)

There are a few reasons why I believe this scenario is the most likely.

Faster Execution

From the start, WBD has structurally favored a buyer like Netflix over Paramount for one primary reason: execution speed.

WBD’s board was advised earlier on to separate its crown-jewel assets (Warner Bros. Studios and HBO Max) from legacy cable networks such as CNN. This simplifies any transaction by allowing strategic buyers like Netflix to acquire premium IP, studios, and a scaled streaming platform without inheriting structurally declining cable networks. As a result, deal complexity and regulatory exposure would be reduced, expanding the universe of credible buyers and accelerating approval timelines.

By contrast, Paramount’s proposal involves acquiring the entirety of WBD, including cable and news. That materially increases regulatory complexity, integration risk, and time to close. The fact that Paramount was the first historical bidder, yet has been repeatedly rebuffed by WBD despite escalating to a hostile offer, is revealing. It speaks directly to board preference for a cleaner, faster transaction.

From a board, management and shareholder perspective, faster cash realization with lower regulatory uncertainty dominates. It also helps that Netflix conveyed its conviction by being the first to offer a $5.8 billion breakup fee, the largest amongst bidders.

Netflix + WBD Synergy

Warner Bros. today lacks the financial strength to fully invest in content and distribution. Netflix stabilizes a key industry player rather than eliminating one, strengthening competition against Disney, Amazon Prime Video, Apple TV+, and YouTube. This is pro-consumer, pro-creator, and pro-competition.

At the recent UBS Global Media and Communications Conference, Greg Peters and Ted Sarandos reiterated that Warner Bros. would continue operating largely as is, with HBO explicitly preserved as a standalone prestige brand rather than being subsumed into Netflix’s broader “general entertainment” umbrella. This directly addresses concerns around HBO brand dilution and strengthens the case that the transaction expands consumer choice and creative breadth rather than homogenizing content under a single platform identity.

Taken together, Netflix offers the fastest, cleanest, and least disruptive path to closing, which is why I view this as the base case.

Outcome 2: Netflix loses the deal due to regulation (Medium chance)

This scenario is possible, but less likely than market fears suggest.

Antitrust Market Share concerns

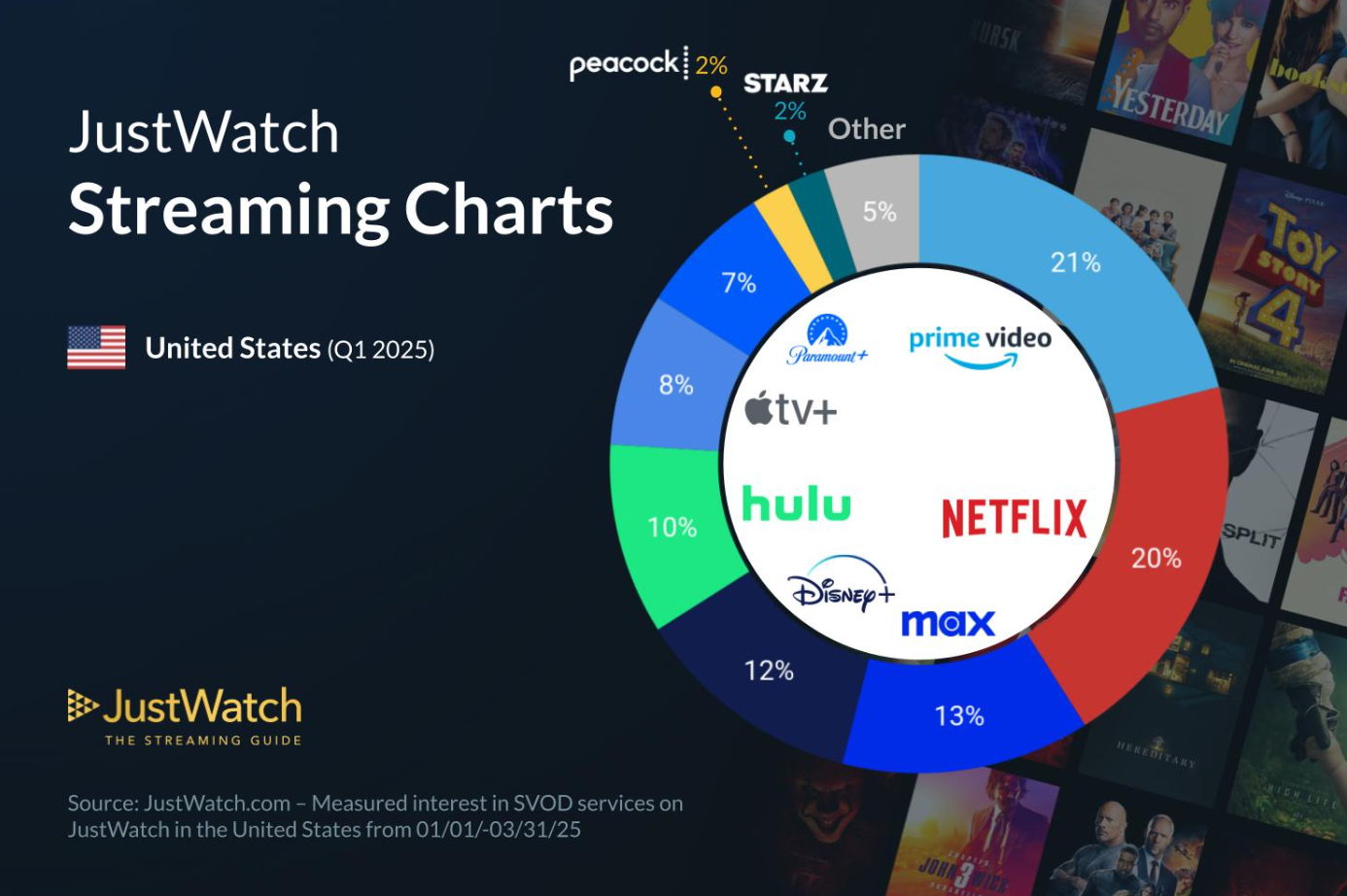

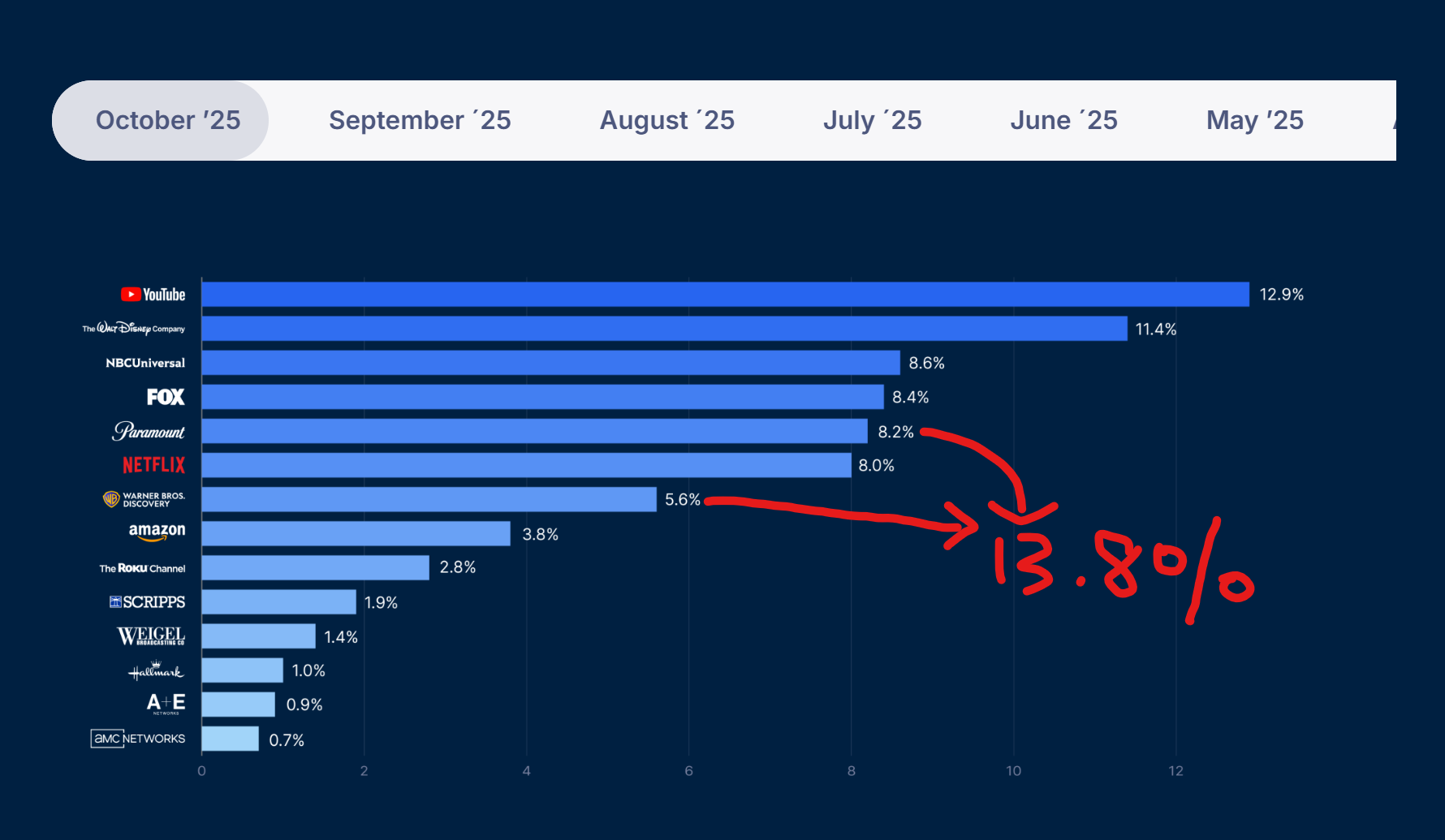

According to UBS estimates based on Nielsen data, the combined Netflix + WBD (excluding cable networks) would control approximately 9.2 percent of US TV viewing share, still behind YouTube at ~12.9 percent and Disney at ~11.4 percent. The fact that Disney-Fox (higher combined share) was cleared before as a precedent, makes me lean towards Netflix + WBD having a high chance of success.

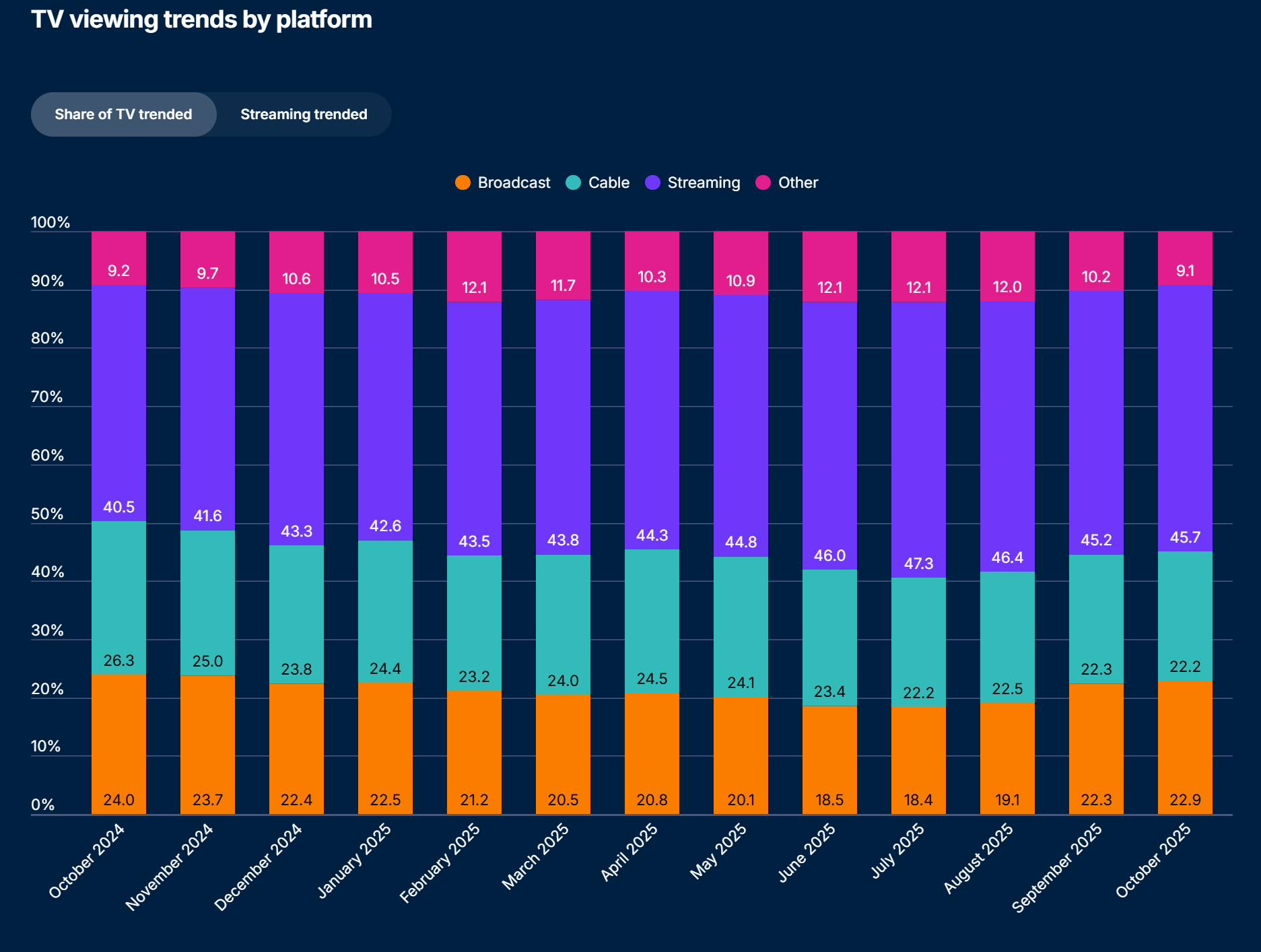

There is, however, a narrower lens through which regulators could raise concerns. Streaming continues to gain share of total US TV time (see below chart), and within the pure SVOD market, concentration would meaningfully increase with a Netflix + WBD Merger.

According to JustWatch, a combined Netflix and HBO Max would control roughly 33 percent of the US SVOD (Subscription Video on Demand) market, exceeding Prime Video’s estimated 21 percent share. This framing underpins Paramount’s argument in its correspondence with WBD and is the most credible basis for regulatory pushback.

Viewed strictly through an SVOD-only lens, the deal would elevate Netflix to pole position. That risk explains why I assign a medium probability to this outcome. While not the most likely scenario, it remains a non-trivial regulatory hurdle, particularly if authorities choose a narrow market definition focused solely on subscription streaming.

There is also the question of Donald trump intervening in this case (Given his close relationship with the Ellison family and his Son-in-law's involvement in the Paramount deal). What most people don't understand is that the president unfortunately does not have the final say in these matters. For e.g. Trump failed to block AT&T + Time Warner previously.

Minimal Job loss

Operationally, Netflix’s acquisition results in minimal job redundancies due to its vertical nature. Netflix is acquiring premium content and studio capabilities to complement its global distribution platform, rather than merging two like-for-like companies.

Warner Bros.’ creative and studio operations can largely remain intact with minimal cost-cutting, whereas a Paramount + WBD deal has significant overlap and would likely result in a lot more job losses.

This matters both politically and regulatorily, where workforce disruption remains a key concern.

In short, the regulatory case against Netflix is weak but not impossible, making this a medium but not dominant risk.

Outcome 3: Paramount wins the bid(Lowest chance)

This is the least likely outcome for a few reasons.

Antitrust concerns

Paramount + WBD would involve a horizontal consolidation of 2 identical entities, resulting in a combined total USA TV market share of ~13.8%, the largest by Nielsen estimates, exceeding even Youtube. Compared to Netflix + WBD's potential 9.2%, antitrust risk is far higher for this deal.

Geopolitical concerns

There are also non-trivial geopolitical and regulatory risks. Paramount’s financing involves foreign and Middle Eastern capital. That introduces national interest considerations beyond standard antitrust review, particularly when iconic American media assets are involved.

Small cap eats big cap?

Another unusual feature of the situation is deal asymmetry. Paramount with a market cap of ~$15 billion, is attempting to acquire Warner Bros. Discovery, which is far larger at ~$74 billion. Transactions where a materially smaller acquirer seeks to absorb a significantly larger media business have historically exhibited poor long-term outcomes.

The canonical example is AOL-Time Warner, where a smaller, high-multiple acquirer effectively took control of a much larger legacy media company. The deal ultimately destroyed substantial shareholder value, driven by execution risk, cultural mismatch, leverage, and misaligned capital allocation. While no two transactions are identical, the precedent reinforces shareholder skepticism toward reverse-scale acquisitions in capital-intensive, creatively driven industries.

When this asymmetry is considered alongside the heightened financing risk, integration complexity, and the $2.8 billion termination fee payable to Netflix if the Netflix + WBD agreement is abandoned, the incentive structure becomes clear. WBD shareholders are rationally inclined to favor the board-endorsed Netflix transaction over Paramount’s hostile bid, where the probability of value creation is materially lower.

In the next premium subscriber section, I cover,

- My long-term Investing Take on this Netflix + Warner Brothers deal

- My Share Price buy levels and portfolio next moves for Netflix, including a valuation-comparison framework informed by key past drawdown events in Netflix's history

My Investing take:

Out of the 3 potential outcomes, my thesis leans towards Outcome 1, where Netflix successfully completes the acquisition of WBD.

In the short-term, Netflix will likely be weighed down on its financials due to the increased USD59bn debt it is taking on as well as integration and restructuring costs.

There are also other factors that prevent Netflix from quickly reaping the full benefits of the acquisition such as the need to honor WBD's traditional theatrical release window until 2029 (which is less scale and margin efficient compared to straight up releasing new content on streaming globally). As such, I expect lots of volatility with the stock going into 2026, especially given media deals of this size usually take time to complete (e.g. AT&T acquisition of Time Warner took 2 years).

In the long-term, I believe this deal is...

🔒Unlock the below with premium tier: