Earnings: Meta Q3

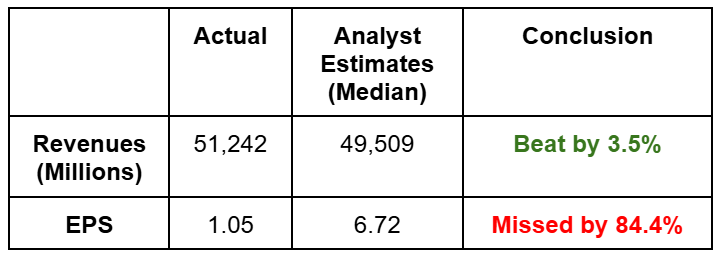

Actual vs Estimates:

- EPS missed due to 1 time USD15.93bn tax charge from 1 Big Beautiful Bill Act.

- Without 1 time tax, diluted EPS would have increased by $6.20 to $7.25 (Beating estimates).

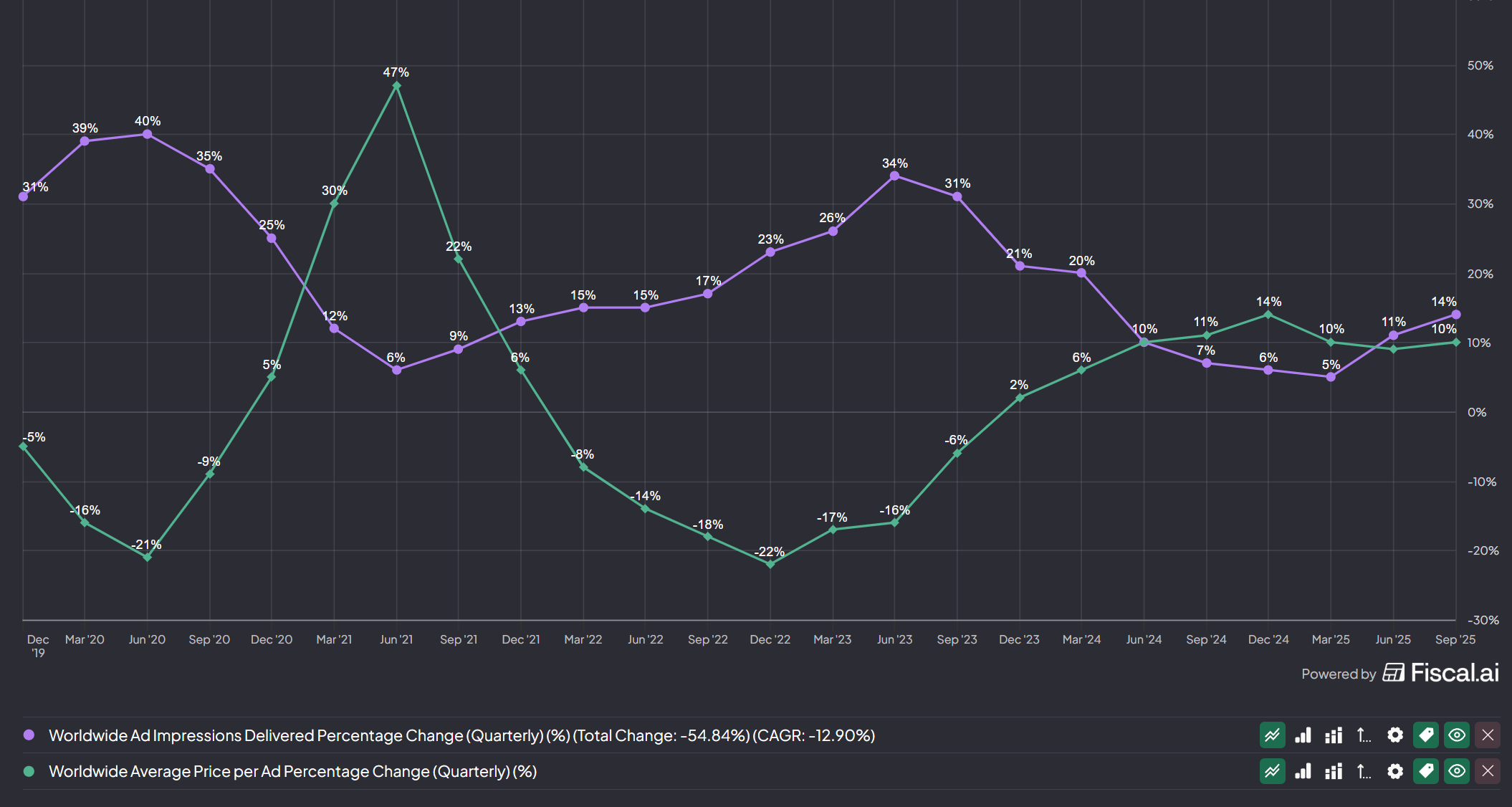

Ad impressions Delivered & Average Price per ad:

Source: fiscal.ai

- Worldwide Ad impressions increased +14% YoY & Average price per ad increased +10% YoY

- There's usually an inverse relationship between the two, where the cheaper ad prices get, the greater the no. of impressions delivered due to auction dynamics (i.e. purple line goes up, green line should go down and vice versa). 2022 was an exception as it was a bounce from extreme negative ad pricing due to macro environment, not true ad efficiencies.

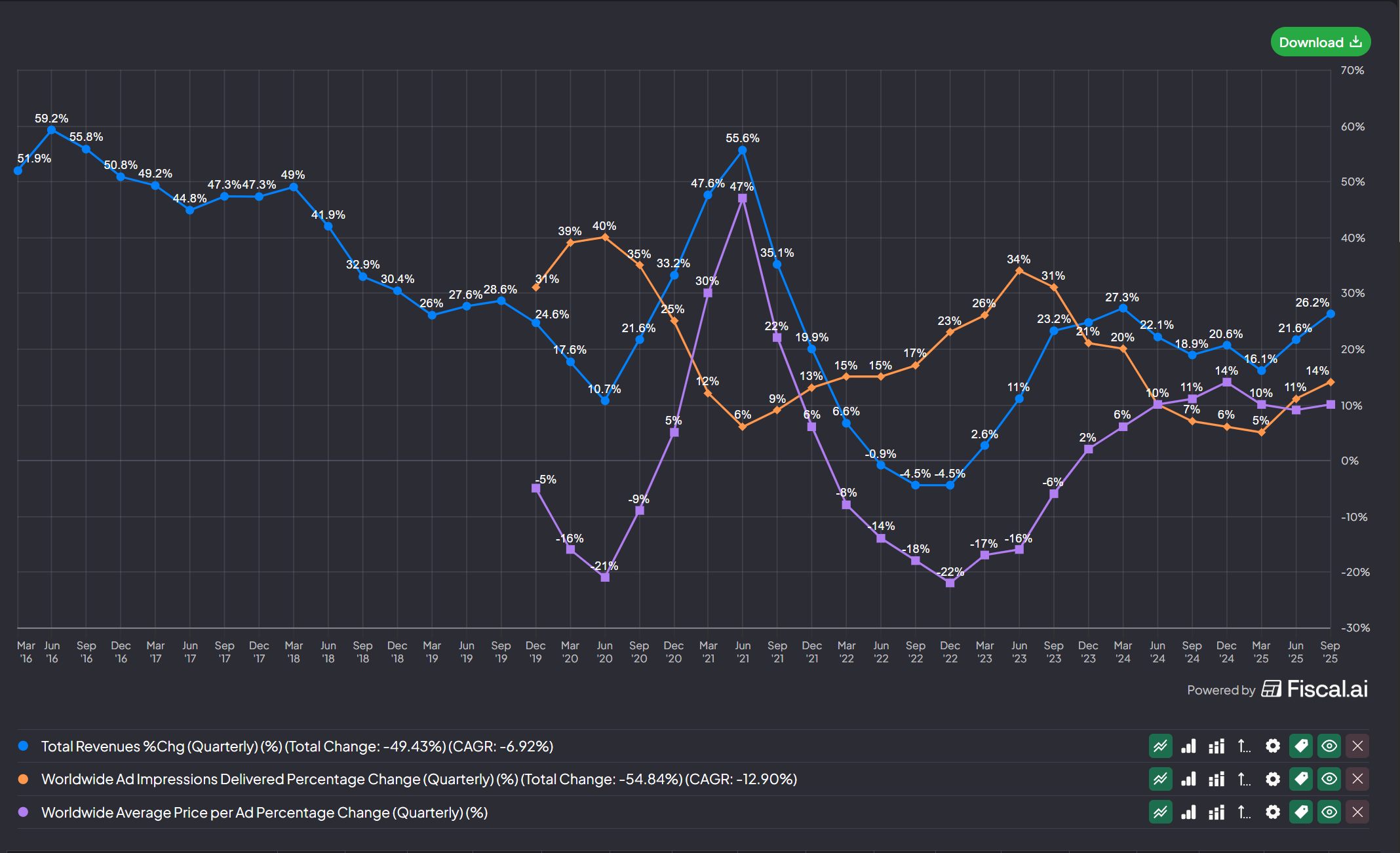

- When both lines go up, it signifies improved efficiencies in ad recommendation systems, resulting in an acceleration in revenues to +26.2% YoY as seen below (blue line)

Source: fiscal.ai

- TLDR, some of the earlier capex investments and infra improvements to boost ad recommendation systems are paying off.

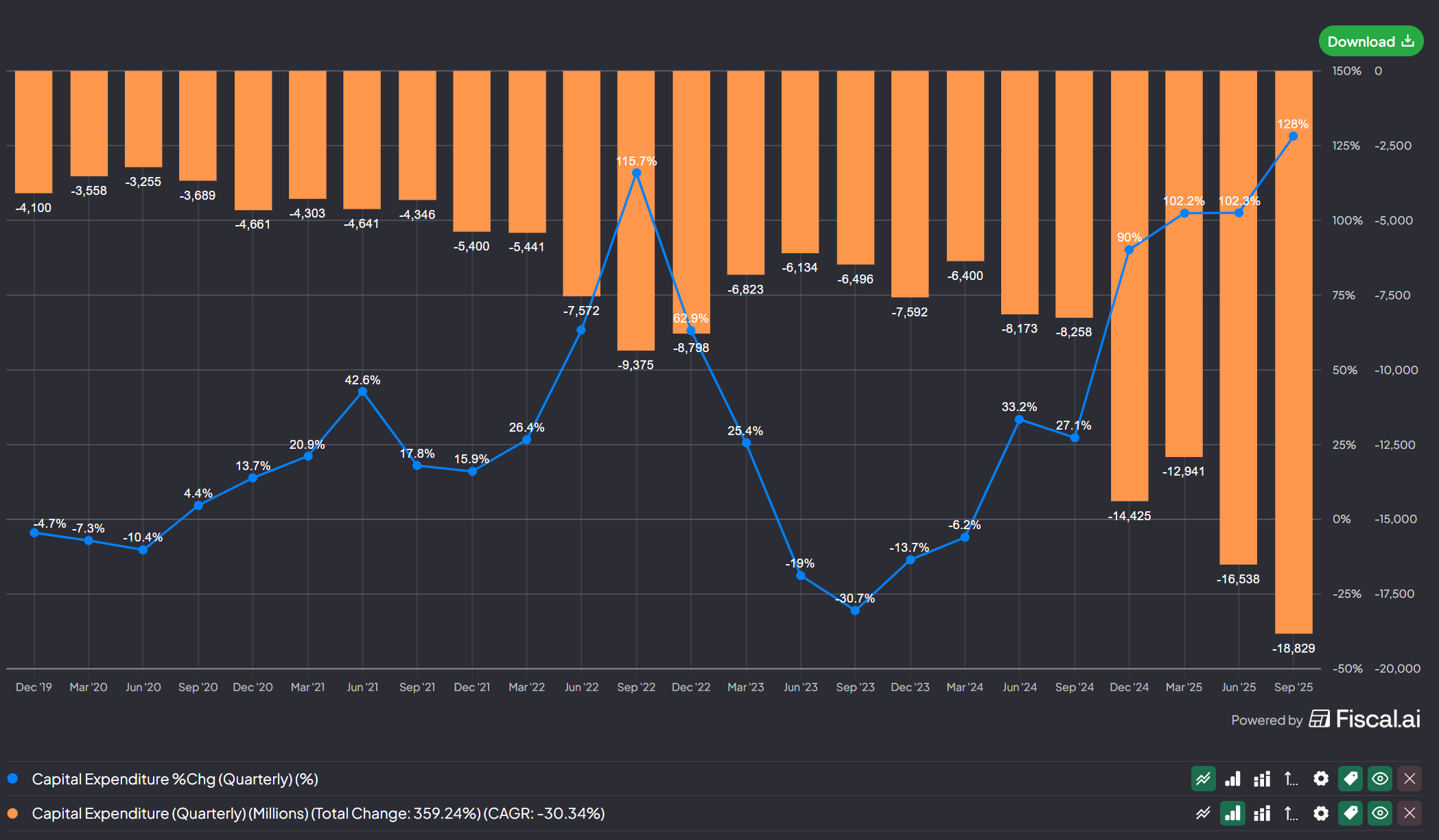

Capex:

Source: fiscal.ai

- Capex continues to climb and is +128% YoY this Q3, fastest it has ever been, beating even the Q3 '22 capex sprint of +115.7% when Meta was forced to,

- Rebuild ads ranking & attribution following Apple ATT

- Boost Reels recommendation infrastructure due to competitive pressure from TikTok.

- Management is guiding to an increase in capex for '25, from $66-72bn to $70-72bn.

- Management mentions "current expectation is that capital expenditures dollar growth will be notably larger in 2026 than 2025"

Opex:

Management anticipates "total expenses will grow at a significantly faster percentage rate in 2026 than 2025, with growth driven primarily by infrastructure costs, including incremental cloud expenses and depreciation. Employee compensation costs will be the second largest contributor to growth as we recognize a full year of compensation for employees hired throughout 2025, particularly AI talent"

With both CapEx and OpEx expected to accelerate sharply in 2026, surpassing even the intensive 2022 build-out, it’s no surprise the Street reacted harshly. META fell 13% from prior day’s close (finishing the session down 11%), marking its largest intraday drawdown in three years.

Earnings call highlights:

Zuckerberg: "I think it's the right strategy to aggressively front-load building capacity so that way we're prepared for the most optimistic cases. That way, if superintelligence arrives sooner, we will be ideally positioned for a generational paradigm shift and many large opportunities. If it takes longer, then we'll use the extra compute to accelerate our core business – which continues to be able to profitably use much more compute than we’ve been able to throw at it. And we’re seeing very high demand for additional compute both internally and externally. And in the worst case, we would just slow building new infrastructure for some period while we grow into what we build."

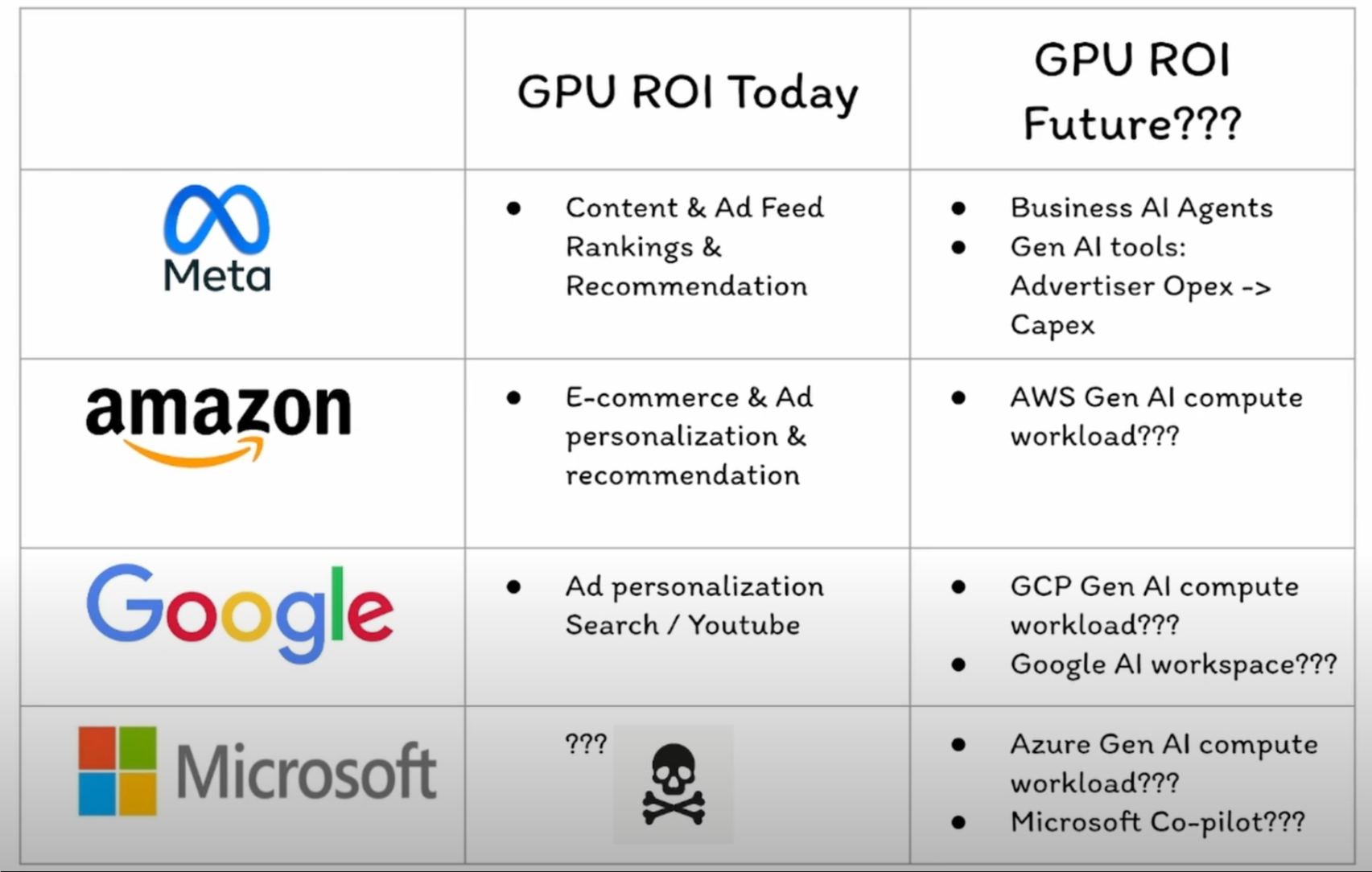

I’ve long argued that Meta occupies a privileged position because the bulk of its core revenue engine directly benefits from incremental GPU spending via recommender-system improvements. This fungibility of GPU utilization reduces the risk of over-investment and creates attractive optionality for future AI workloads.

By contrast, hyperscalers like Microsoft lack the same internal ROI flywheel: their GPU economics depend heavily on external enterprise demand for Azure AI. If an AI spending bubble were to unwind, the fallout would be more severe for Microsoft, which would have fewer avenues to repurpose its AI CapEx compared to Meta.” (See diagram below)

Zuckerberg: "We see that there’s just a lot of demand for other new things that we build internally, externally. Like almost every week, people come to us from outside the company asking us to stand up an API service or asking if we have different compute that they could get from us. And we haven’t done that yet, but obviously if you got to a point where you overbuilt, you could have that as an option"

I am a bit surprised by this comment from Zuck. Anecdotally, as a Software Solutions Engineer working in the field, Llama models are still meaningfully behind the frontier systems from OpenAI, Google, and Anthropic.

Even on LMarena's text leaderboard, the largest Llama 3.1 405b instruct model sits at #77, well below the cutting-edge.

While there may be security concerns around Chinese open source LLMs, there are other credible alternatives such as gpt-oss or Mistral. This leaves me curious about the companies actively requesting Llama based API services today.

My takeaway is that Meta’s ability to repurpose surplus compute for external API consumption, should CapEx overshoot, feels optimistic and is not a valid hedge (ceteris paribus the current trajectory of Llama’s capabilities). In fact, should Meta start significantly standing up an API service, I’d take that as a yellow flag that they’ve over-invested in capacity to the extent even Family of Apps isn’t utilising it.

Zuck: "there’s – the one opportunity that we just usually talk about on these calls, but hasn’t come up as much here is just the ability to make it so that advertisers are increasingly just going to be able to give us a business objective 16 and give us a credit card or bank account, and have the AI system basically figure out everything else that’s necessary, including generating video or different types of creative that might resonate with different people that are personalized in different ways, finding who the right customers are. All of the capabilities that we’re building, I think, go towards improving all of these different things. So I’m quite optimistic about that"

Zuckerberg’s comments on a more automated Advantage+ advertising system matter for three reasons.

- First, it expands Meta’s addressable market by removing the expertise barrier that limits small business adoption. Many SMBs under-spend today not due to lack of demand, but because they lack the marketing capabilities or resources required to run sophisticated campaigns.

- Second, it boosts post-ATT performance because the model can rely on probabilistic signals and feedback loops rather than manual targeting heuristics.

- Third, it increases Meta’s GPU ROI, since every improvement to ranking and creative quality directly lifts revenue.

If Meta succeeds, advertising complexity collapses, and budget moves to the platform that delivers results with the least friction. This is the clearest path yet to monetizing Meta’s massive AI infrastructure.

When an analyst asked whether Meta’s Reality Labs investment in wearables could ever be recouped through hardware sales alone, or if the business model depended on new revenue streams such as advertising, services, and commerce, Zuck emphasized that the opportunity is not the device itself, but the software and AI that run on top of it:

"I think that there’s some revenue that we get from basically selling the devices and then some that will come from additional services and from the AI on top of it. So I think that there’s a big opportunity. Certainly, the investment here is not just to kind of build a – just the device. It’s also to build the services on top"

This is the familiar platform sequence: subsidize hardware, build distribution, and monetize through software and ads once the interface becomes habitual.

I recently spoke with a tech partner who worked with the Evenrealities team in Shenzhen. Their AI glasses reportedly cost over USD200 to produce despite shipping only a single-colored green HUD. He believes Meta’s Ray-Bans cost northwards of USD400+ before logistics, implying the USD799 display models are likely selling at breakeven or a loss today. His view is that Meta is flooding the market early to deny runway to emerging competitors.

That strategy makes sense. After Apple’s ATT changes, Meta learnt the cost of building on someone else’s platform. Owning the interface means owning the rules and he's willing to go all out to achieve this long term.

In the near term, this is a cash burn category until component prices fall and an app ecosystem develops. But over time, the payoff is control: a first-party computing platform where Meta’s agents, ads, and commerce run natively. For Zuckerberg, this is not eyewear; it is a bid to ensure Meta never again relies on another company’s operating system.

I am optimistic that Zuck has the right skin in the game (~90% of his personal networth in Meta shares) and soul in the game to play the long game and am confident that glasses are the right form factor for the next platform shift in line with advances in AI - They see what we see, hear what we hear and can parse that information and display the appropriate content on HUD lenses without us having to look down on our phones.

In addition, time is very much on Meta’s side compared to OpenAI’s push to build an AI wearable device. OpenAI’s success hinges on continuously raising capital, at what appears to be an increasingly unsustainable pace, to fund both AI model training and specialized hardware development. Meta, on the other hand, enjoys a cash-rich core business that can internally finance the long march toward profitable AI glasses. They don’t need to bet the company on external capital markets.

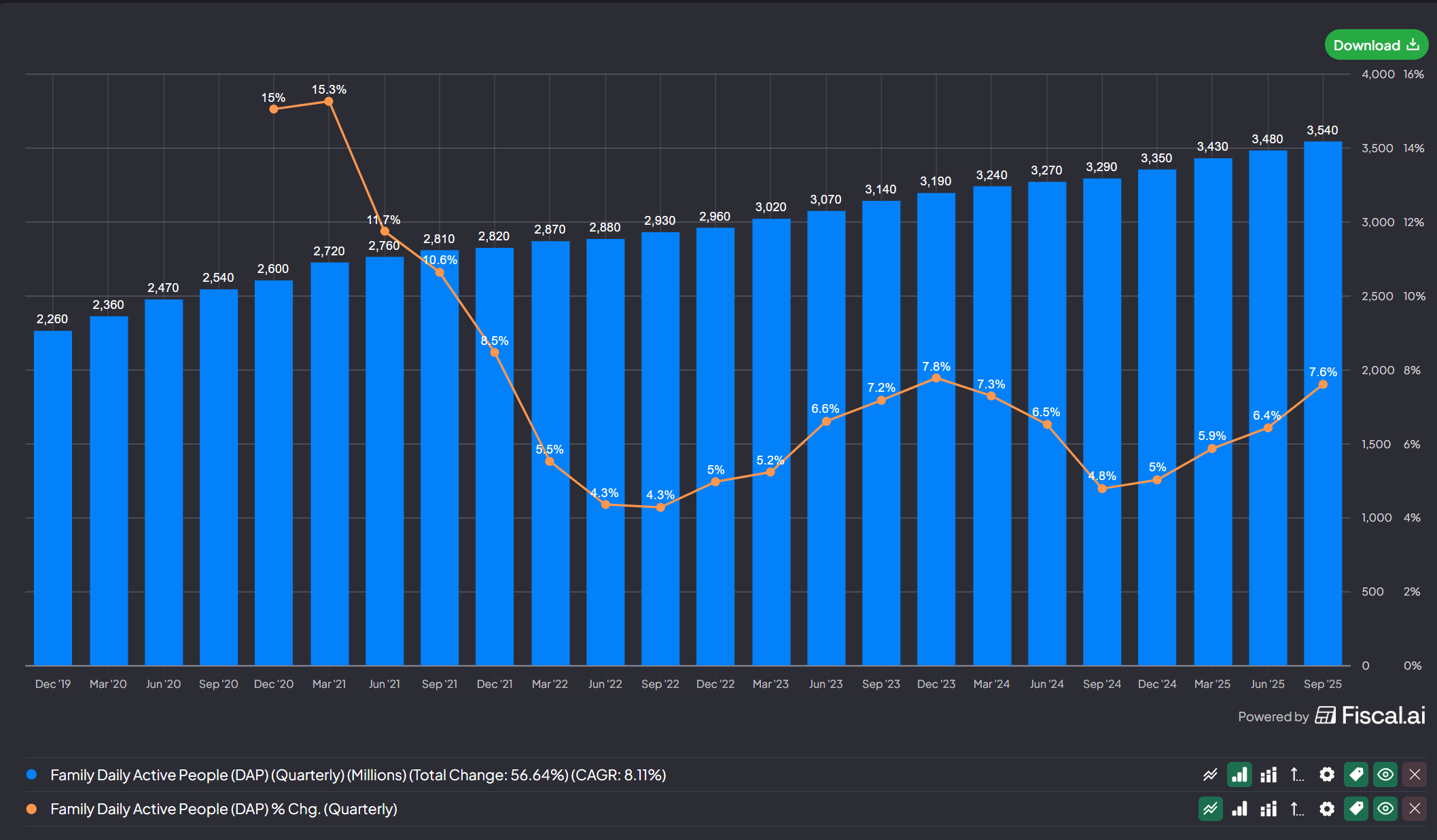

We only need to look at Meta’s recent growth trajectories to understand how much cash this engine can produce in the short to medium term to support the AI revolution’s capex buildout:

- Reels revenue surged from $1B in Q2 ’22 to a $50B annualized run-rate in Q3 ’25 - a staggering 50× growth in just three years (equivalent to ~268% CAGR).

- Threads expanded from 100M DAUs to 150M DAUs in just 12 months.

- Family of Apps DAUs grew +7.6% YoY to reach 3.5 billion users (see chart below) - more than half of the global internet population and nearly 88% penetration when excluding restricted regions such as China and North Korea!

Source: fiscal.ai

In the short-to-medium term, I expect meaningful volatility as accelerating CapEx, higher D&A, and AI talent costs compress margins heading into 2026. This will likely provide lots of opportunities for me to average into this stock. Unlike other hyperscalers, Meta enjoys GPU fungibility: every incremental dollar of compute can be deployed into ranking, recommendation, creative optimization, and personalization - all of which drive revenue today as we've seen with Reels' growth. That meaningfully reduces overinvestment risk.

Portfolio View & My Next Investment Steps:

Note: The following does not constitute financial advice/recommendations and is merely a journal of my own portfolio investment actions.

I have updated my buy levels as follows below (🔒Unlock with premium tier):