Earnings: Amazon Q3 - 1 Yellow flag spotted

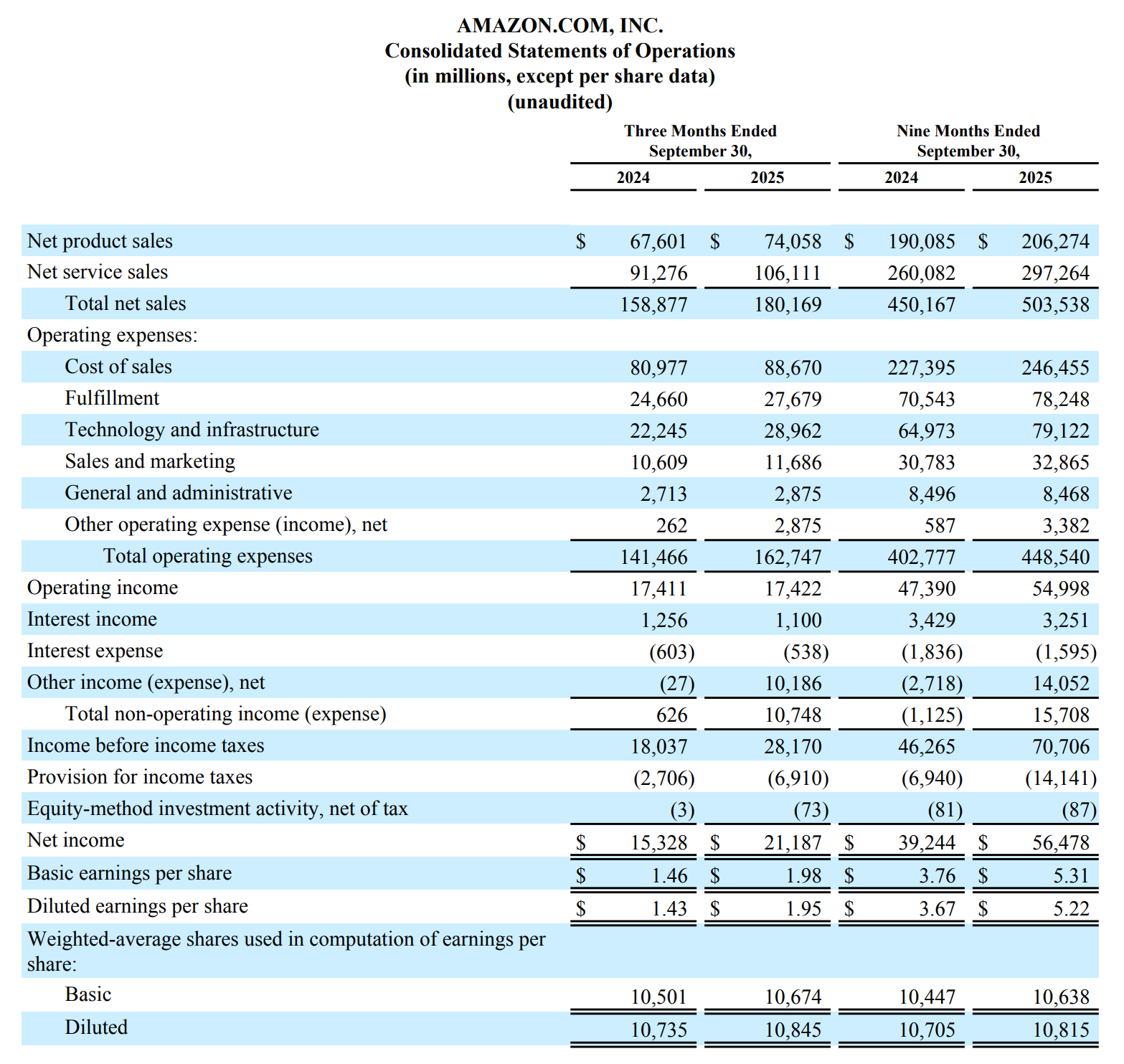

Actual vs Estimates:

The headline EPS beat includes,

pre-tax gains of $9.5 billion included in non-operating income (expense) from our investments in Anthropic, PBC.

as well as,

two special charges—$2.5 billion related to a legal settlement with the Federal Trade Commission and $1.8 billion in estimated severance costs primarily related to planned role eliminations. Without these charges, operating income would have been $21.7 billion.

Since severance costs are likely to remain an ongoing feature of Amazon’s labor optimization, I’ve chosen to normalize EPS excluding the FTC legal settlement and the non-operating valuation gain on the Anthropic investment.

Approximate Amazon's effective tax rate

- Income before taxes: $28.170B

- Provision for income taxes: $6.910B

- Effective tax rate ≈ 6.910 / 28.170 ≈ 24.5%

Anthropic gain (after-tax)

- Pre-tax gain = $9.5B

- After-tax multiplier = (1 − 0.245) = 0.755

- Anthropic gain (after-tax) = $9.5B × 0.755 ≈ $7.17B

Add back FTC legal settlement (after-tax)

- Pre-tax = $2.5B

- FTC Legal settlement (after-tax) = $2.5b x 0.755 ≈ $1.8875B

Compute adjusted net income

- $21.187B (Initial Net income) - $7.17B (Remove Anthropic gain) + $1.8875B (Add back FTC settlement) = $15.9045B

Normalized EPS without FTC and Anthropic effect

Normalized EPS = 15.9045B ÷ 10.845B shares

≈ $1.47

So going back to our table,

EPS would have missed by 6.25% excluding Anthropic’s investment gain and the FTC settlement (although operating income would actually be up YoY rather than flat if we normalize for that same settlement).

Post-earnings, the market rewarded AMZN with a nearly +10% post-earnings rally. This is exactly why I never play the earnings-prediction game. The market is wildly unpredictable in the short term, and unparsed headline figures can distort sentiment in ways that don’t fully reflect underlying fundamentals. Instead, I prefer to make investment decisions after earnings, when valuations settle closer to ranges I’m comfortable with.

But of course, there was one clear reason to celebrate:

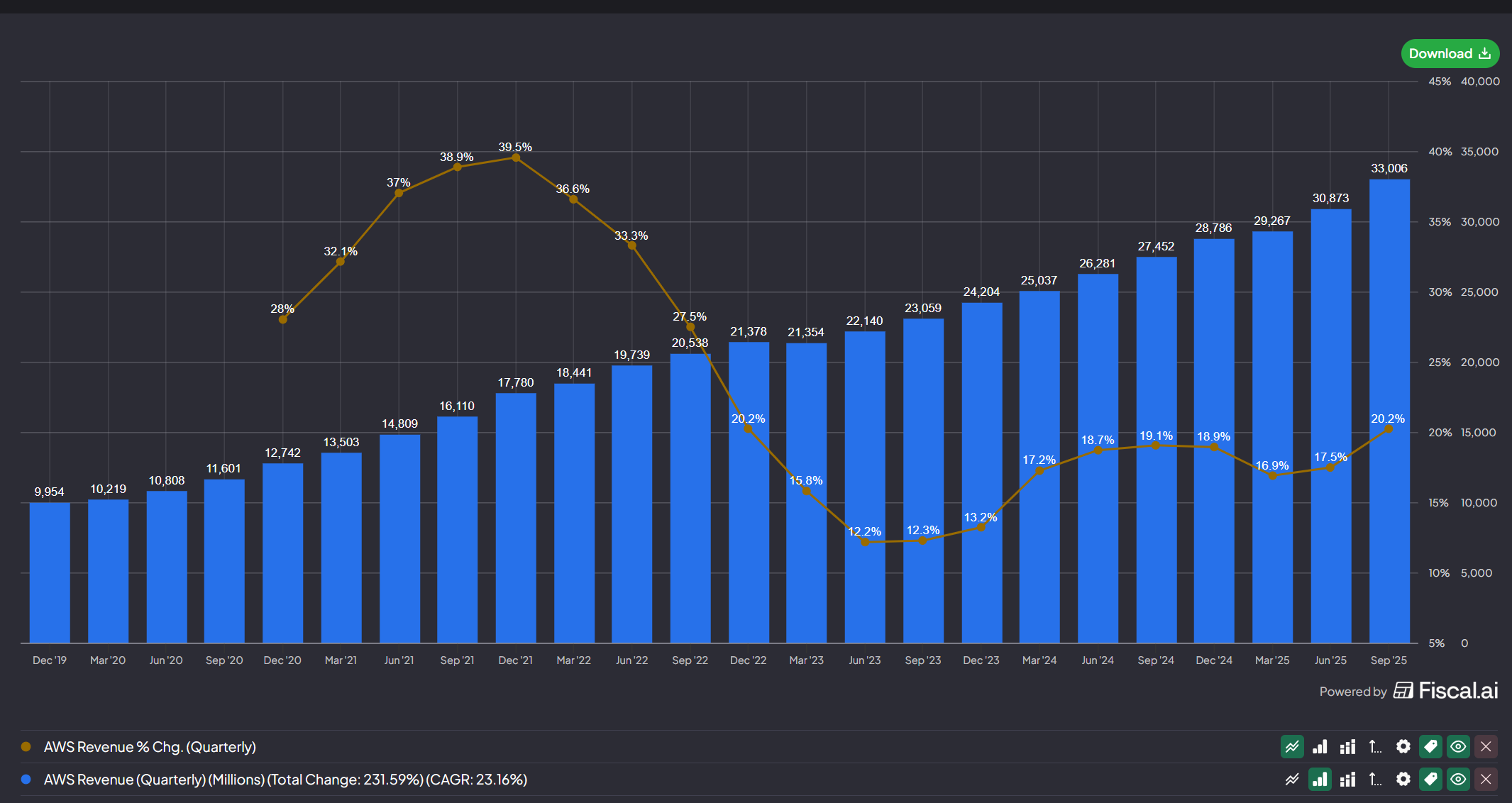

AWS:

Source: fiscal.ai

AWS revenues are starting to re-accelerate at 20.2% YoY. Andy Jassy made sure to emphasize this:

It's very different having 20% year-over-year growth on a $132 billion annualized run rate than to have a higher % growth rate on a meaningfully smaller annual revenue, which is the case with our competitors

To be fair, he has a point as Azure's last disclosed run-rate was $75bn last quarter, and even if we assume that scaled to ~$80bn run rate this Q3 '25 for Microsoft, AWS still remains ~60% larger.

The gap is even more obvious with Google Cloud with a $60 billion run-rate growing 33.5% YoY (chart below) - impressive, but still from a much smaller base.

Source: fiscal.ai

In response to an analyst's question on capacity constraints during the earnings call, Jassy had this to say:

Today, overall in the industry, maybe the bottleneck is power. I think at some point it may move to chips, but we're bringing in quite a bit of capacity.

This seems to be a recurring theme across the industry. In the recent BG2 interview with Satya Nadella and Sam Altman (yes, the one where Sam shuts down Brad Gerstner), Nadella commented:

...the biggest issue we are now having is not a compute glut but it's a power and it's sort of the ability to get the builds done fast enough close to power

In addition, from Alpha-sense's interview with a Current Google employee working on datacenters.

Supply chain GPUs, which we all want to get, GPUs and TPUs, we have our own internal TPUs, but the GPUs from NVIDIA, either we buy them or we can rent from someone like CoreWeave or something like that. That’s really not a big constraint. Power, lack of available power, reliable power has become the biggest bottleneck for us

The above doesn’t spell good news for Nvidia in the short to medium term, because it suggests the pace of GPU purchases is normalizing to the point where power, not chips, has become the binding constraint. Combined with AWS’s Project Rainier, all signs point to Amazon gradually reducing its dependency on Nvidia over time. Adding to this concern with Nvidia, is recent news that Anthropic signed a deal for TPUs

Of course, Jassy was careful not to offend the kingmaker, following up on the earnings call with:

"We have a very deep relationship with NVIDIA. We have for a very long time, and we will for as long as I can foresee the future. We buy a lot of NVIDIA. We are not constrained in any way in buying NVIDIA. I expect that we'll continue to buy more NVIDIA, both next year and in the future"

There is one yellow flag in the earnings call where Amazon investors should pay attention to. When asked about Project Rainier's 500k Trainium 2 chips (scaling to 1 million by end '25), Jassy mentions:

Project Rainier is something that is specific for Anthropic

Should Anthropic go bust, there would be a double whammy effect for Amazon. On one hand they hold a 15-19% stake in Anthropic; on the other, AWS has architected all 1 million Trainium 2 chips specifically to Anthropic’s Project Rainier. That means Amazon is unlikely to be able to easily repurpose those chips for other customers’ workloads should shit hit the fan and in the words of Bezos, this seems to be a 1 way door decision.

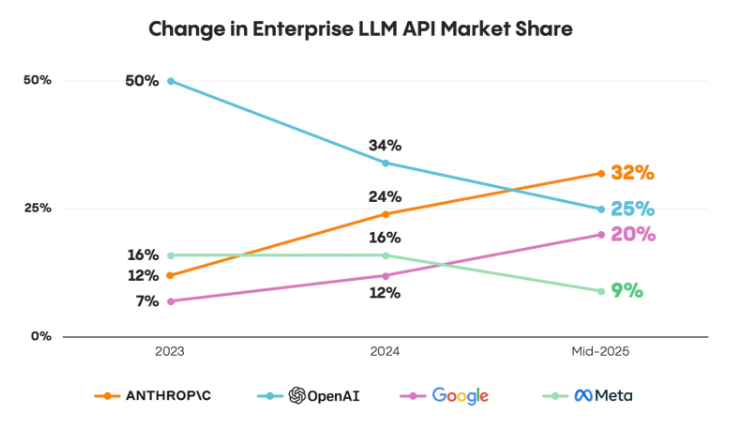

The silver lining here is Anthropic is gaining market share:

When asked about Agentic commerce, Jassy had this to say:

We're also. Having conversations with and expect over time to partner with third-party agents.

I find it curious that so far, only Shopify, Etsy and Walmart have signed up for ChatGPT's Instant Checkout Agentic commerce and Amazon is nowhere to be seen on that front and has, in fact, begun blocking AI Bot traffic.

I believe there are a few reasons why Amazon won't sign up to ChatGPT as quickly as Walmart did.

1) Amazon already dominates “known goods”

As the #1 online destination for commodity items (e.g., “32-pack AA batteries”, “Anker USB-C cable”), ChatGPT’s traffic is unlikely to be significantly incremental. These purchases are less about discovery and more about habitual replenishment. Walmart, as the #2 ecommerce platform, has more incentive to experiment with new customer acquisition channels - even if those channels provide only marginal gains.

2) ChatGPT's Instant Checkout threatens Amazon’s highest-margin business: Advertising

If product selection shifts toward ChatGPT-based ranking, bidding, and affiliate routing, Amazon risks losing ad impressions, conversion attribution visibility, and the downstream economics that make Sponsored Products so lucrative.

3) Anthropic creates strategic conflict

Amazon is an investor in Anthropic, whereas Walmart isn’t. Feeding ChatGPT additional monetization channels could compromise Anthropic’s competitive position. In that scenario, supporting ChatGPT might end up being more of a bane than a boon, especially when considering the “double whammy” risk mentioned earlier.

But of course, if we give Jassy the benefit of the doubt for why he has yet to embrace the ChatGPT integration, he's not entirely wrong:

I would say the customer experience is not good. There's no personalization. There's no shopping history. The delivery estimates are frequently wrong. The prices are often wrong. We've got to find a way to make the customer experience better and have the right exchange of value

*Sliding in an update hot off the press:

Openai just announced a USD38bn multi-year deal with Amazon.

Now we know what Jassy meant by the following in his earnings remarks:

Backlog grew to $200 billion by Q3 quarter end and doesn't include several unannounced new deals in October, which together are more than our total deal volume for all of Q3.

It's Openai!

Portfolio View & My Next Investment Steps:

Note: The following does not constitute financial advice/recommendations and is merely a journal of my own portfolio investment actions.

In light of the yellow flag associated with AWS’ Project Rainier commitments and my broader thesis that we are in the early stages of an AI bubble (more on this in another article), I am approaching additional purchases of $AMZN with caution, even though I remain long-term optimistic about this company.

It’s funny how my portfolio plans for $AMZN have evolved: they were once the flagship commoditizer of LLMs, but are now essentially all-in on Anthropic.

I have updated my buy levels and corresponding next moves regarding $AMZN stock as follows below (🔒Unlock with premium tier):