A Bold $100,000 Bet into AXON - Warning: Not Financial Advice

In this article, I share,

- An insane rollercoaster ride with real broker screenshots

- Why shares fell recently

- Falling knife or Value buy?

- My Next Investment steps in the coming days & Valuation Buy levels (🔒Unlock with premium tier)

Insane Rollercoaster Ride

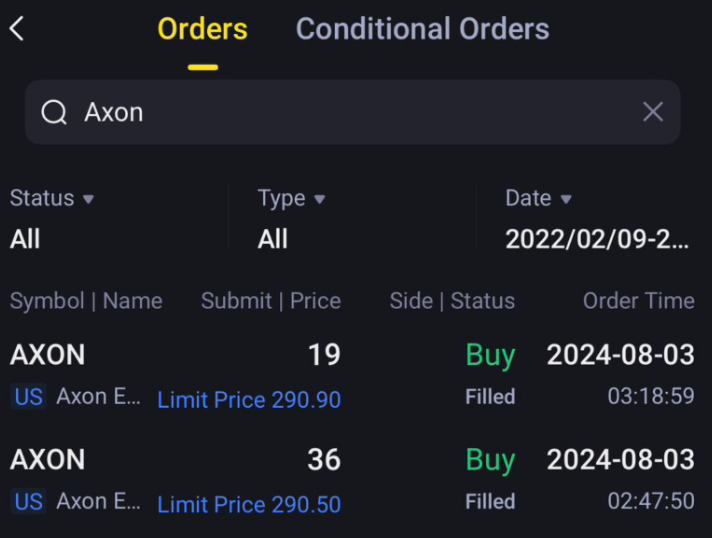

I first bought AXON at USD290.90 (See Broker Screenshot below) 2 years ago in August 2024 after discovering its strong competitive advantages (See full thesis and how I determine moats here).

Along the way, I continued to average into the stock slowly during dips and at one point at its peak, this initial USD290 tripled to USD885.

Shortly after reaching its peak, AXON fell ~54% from 52-week highs of USD885.95 to USD415 within 6 months.

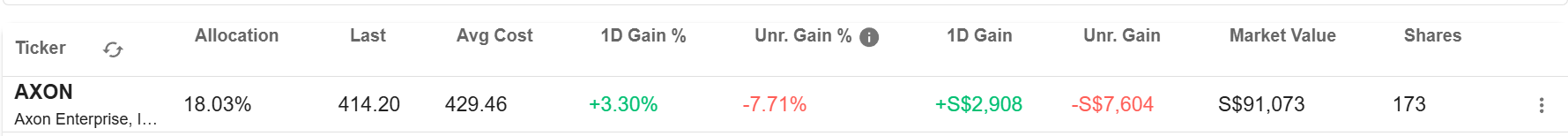

Over 1.5 years of averaging in during dips, my average cost in the position is USD429.46 (See screenshot below).

At one point the Unrealized Gain (%) Column was over +100% but has since fallen to -7.71%.

Throughout this entire rollercoaster ride of 1.5 years when the stock doubled, tripled and subsequently crashed by half, I sold zero stock.

Why did I hold onto all AXON shares throughout this immense volatility and recent dip? And why am I considering a move to top-up the position beyond the $100,000 mark?

To answer these questions, let's first talk about why AXON shares fell in recent times.

Why AXON shares fell

Here's a timeline of major news that affected the stock since its 52-week All Time High of USD885 back in Aug 2025:

Sept 2025: Axon announces acquisition of Prepared, sending shares down -10% in a single day

Nov 2025: Axon missed profit expectations due to tariffs and rising costs and announces acquisition of Carbyne, stock gaps down -20% the next day

End Jan - Early Feb 2026: US Software stocks fell with the release of Anthropic's Claude Co-work tool, wiping out USD1 Trillion from the US market, Axon crashes a further -20% in sympathy.

In between these news, the stock price could have moved for any number of reasons including valuation re-rating, algo-trading or sector rotation (who knows!).

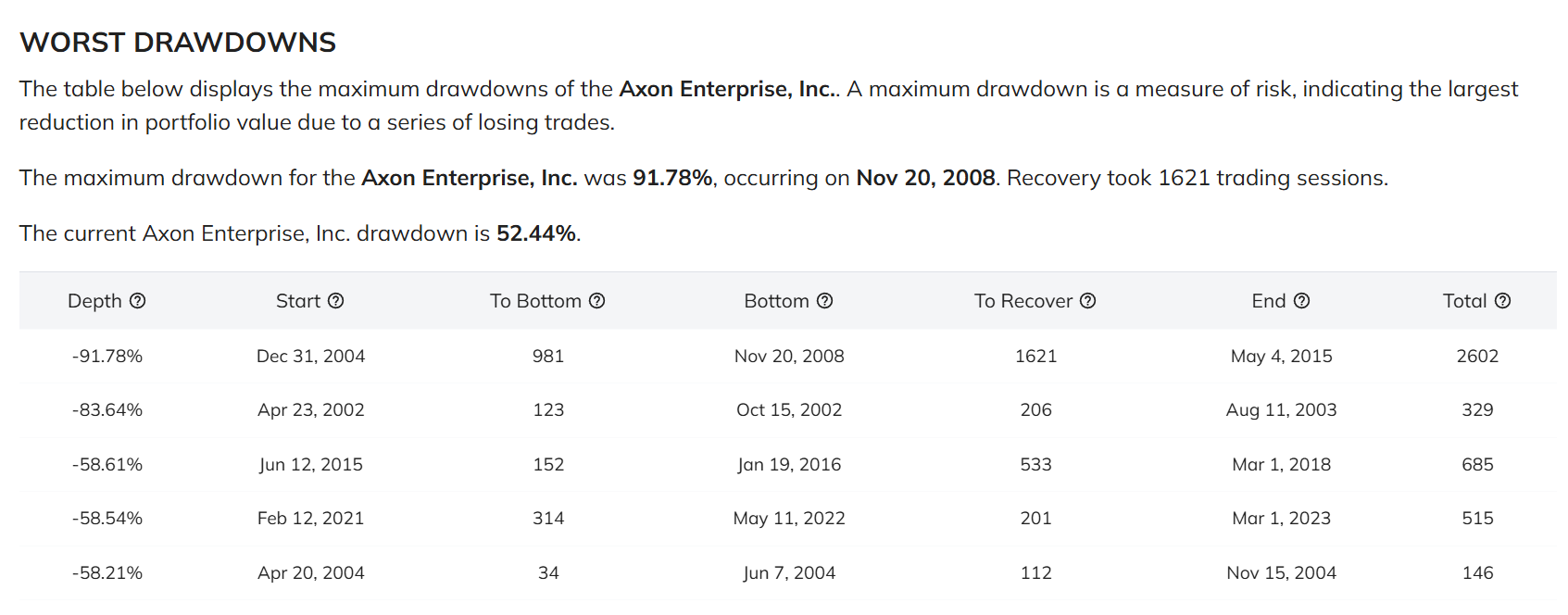

In fact, looking at AXON's 25 year trading history, crashes of 50% or more have occurred a number of times - including the 2002 Dotcom, 2004 SEC case, 2015 re-rating, 2022 Fed Crash, and more recently the AI SaaSpocalypse hitting software stocks, see below:

Falling knife or Value buy?

So the million dollar question is, can Axon rebound from its ~50% crash as it has over the last 25 years?

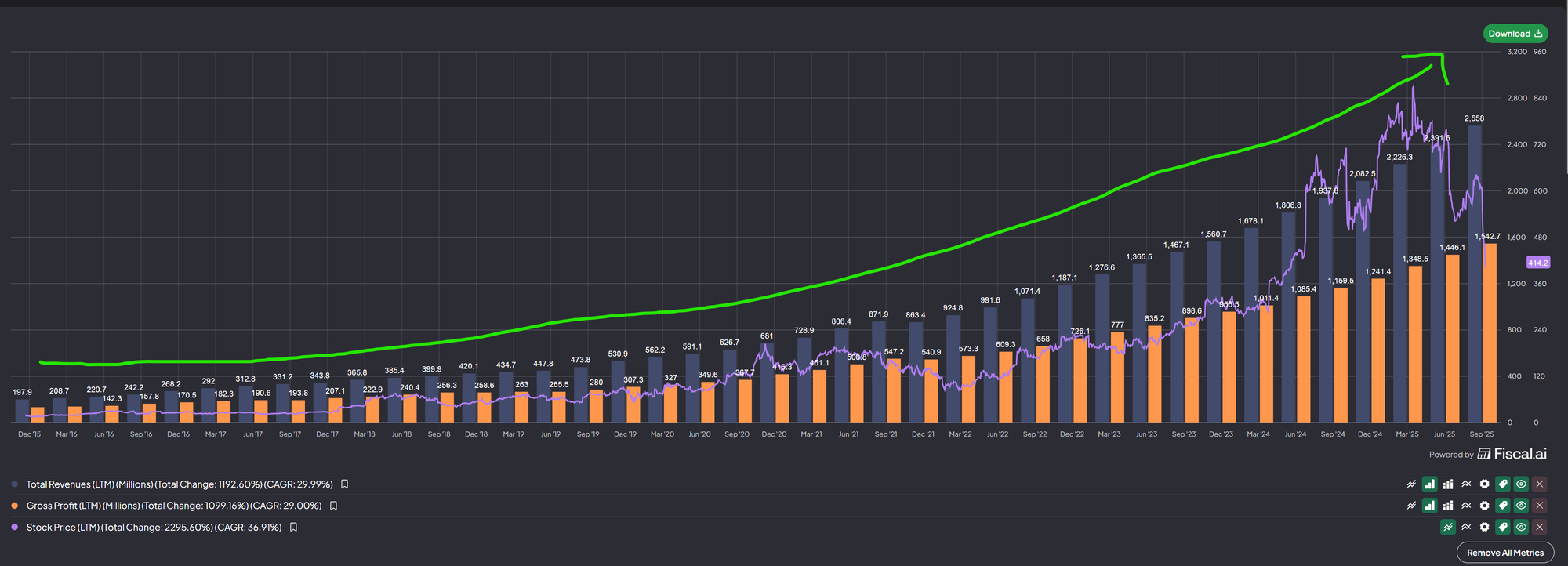

Let's focus on the thing that matters the most - the business fundamentals. In each of the charts below, I also include the Stock price so we can visualize how it tracks the fundamentals over time.

Over the last 10 years, AXON's Revenues and Gross Profit has consistently risen at a CAGR rate of roughly ~30% each year.

To be prudent, let's also study how the Operating Cashflows (OCF) & Free Cashflows (FCF) have performed. Below, we can see that over the past 10 years, cashflows has grown higher in a cyclical fashion (Due to AXON's continuous reinvestments into hardware and cloud infrastructure).

The cyclical nature of AXON’s cashflows looks scary at first, but when you compare it with two other companies that have performed well and are known for aggressively reinvesting cash flow back into the business in cycles, a similar pattern emerges of cash flows rising over time, albeit in a cyclical manner.

Given that the overall trend of AXON's revenue, profits and cashflows is generally positive trending, why does the stock still go through so much volatility?

Benjamin Graham, the father of value investing has a famous saying:

In the short run, the market is a voting machine but in the long run, it is a weighing machine.

In the short-term, stock price can rise and fall due to emotional fear or greed of market participants. But in the long-term of 5 years to a decade and beyond, the fundamentals of the business always wins out and the stock price tends to trend with strong fundamentals.

This is the reason why in-spite of all the short-term dips along the way (like what we just witnessed over the past 1.5 years), in line with growing business fundamentals,

- Over the past 5 years, Axon saw its stock price increase by +147%

- Over the past 10 years, Axon saw its stock price increase by +2,617%

In both instance, beating the market handsomely.

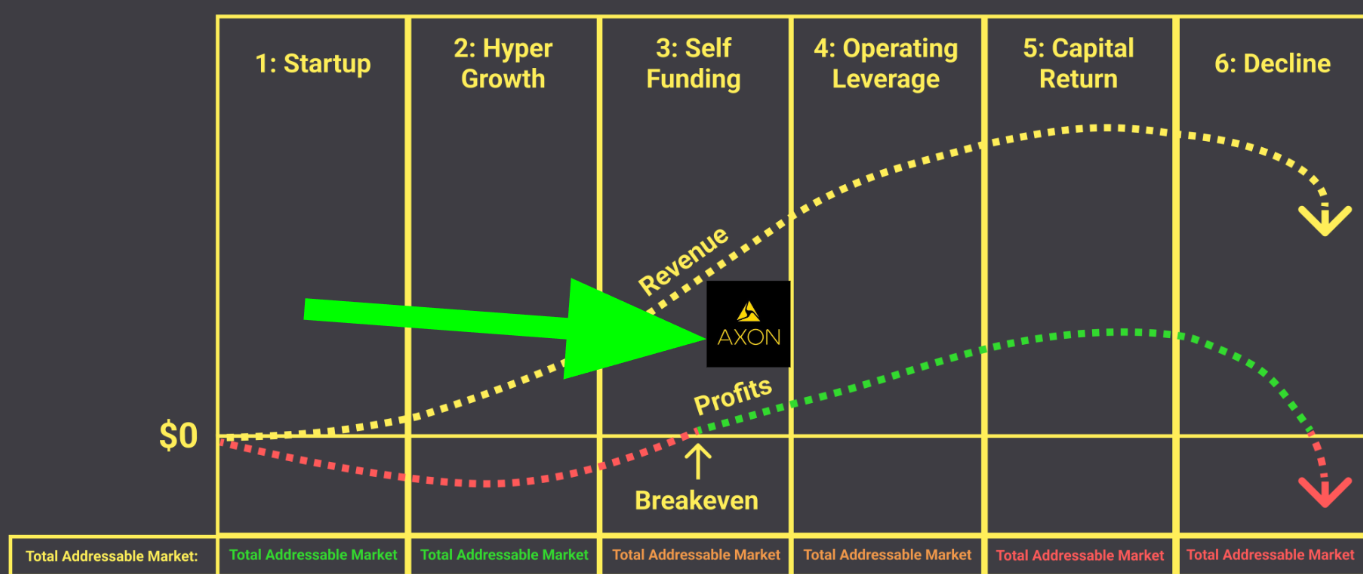

Given that Axon is still in the Self Funding Early Growth stage (see diagram below) unlike more mature tech companies (e.g. Microsoft, Meta, etc.), I expect lots of volatility with the company in years to come and it is simply part of the game as a long-term growth investor and is not for the faint of heart.

There are 3 reasons why I continue to hold Axon and remain long-term optimistic, selling zero shares in the past 1.5 years:

Reason 1: Mission Critical Long Term Moat

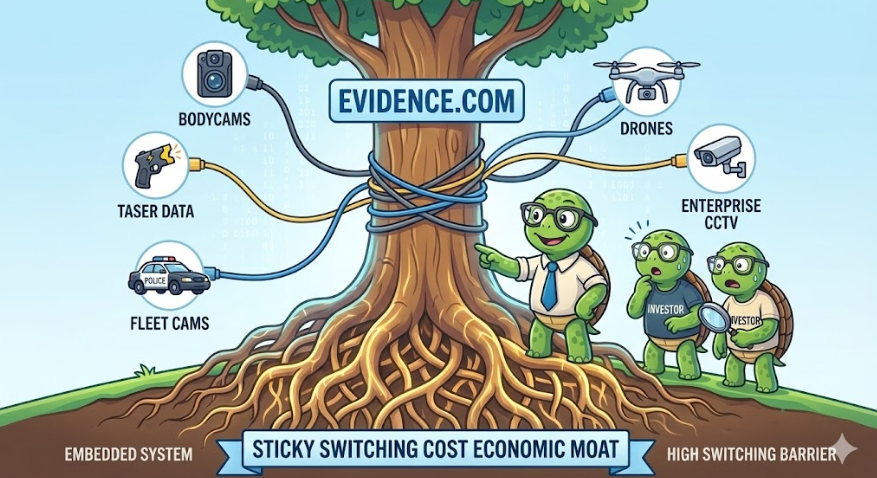

As discussed in this article, Axon’s integrated hardware ecosystem, including Tasers, body cameras, and sensors, combined with the Evidence.com cloud platform, creates a highly sticky moat that supports durable, long-term cash flow generation.

While financial analysts have criticized the recent acquisitions of Carbyne and Prepared (transactions that contributed to recent stock volatility), these concerns focus on short-term impacts to reported earnings and cash flow. From a long-term investor’s perspective, these acquisitions meaningfully deepen Axon’s platform moat by expanding its presence across the full public safety workflow, further reinforcing customer lock-in.

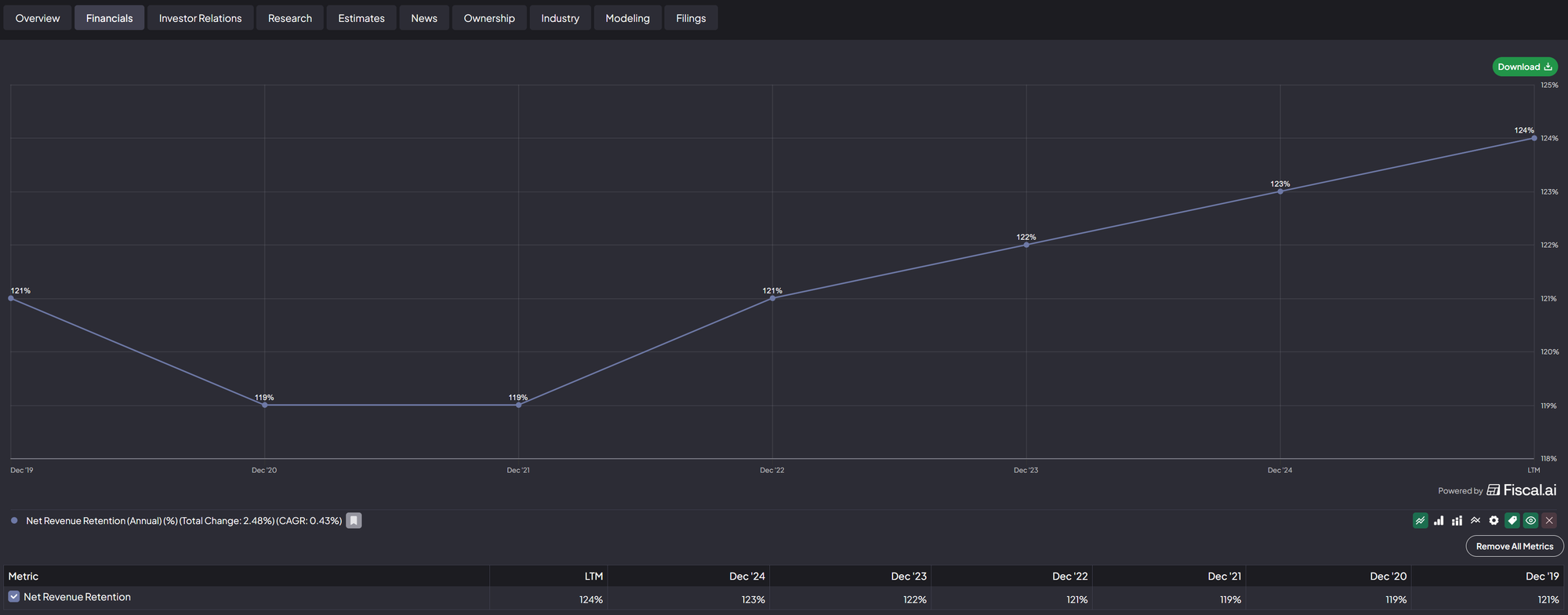

The company's increasing NRR (124% LTM) over the past 10 years is proof of their strengths in customer retention and upselling:

Furthermore, the prevailing SaaSpocalypse narrative does not apply to Axon in my view. Axon is not a pure-play software company, and AI acts as an incremental revenue and earnings enhancer rather than a disruptive force. The AI Era Plan strengthens the value of Axon’s bundled offering instead of commoditizing it and I do not see a future where agents can easily 'replicate' Axon's intricately woven ecosystem.

Taken together, these factors substantially weaken the fundamental bear case behind the recent share price decline, aside from valuation compression following an extended period of multiple expansion.

Reason 2: A path to structurally higher profitability

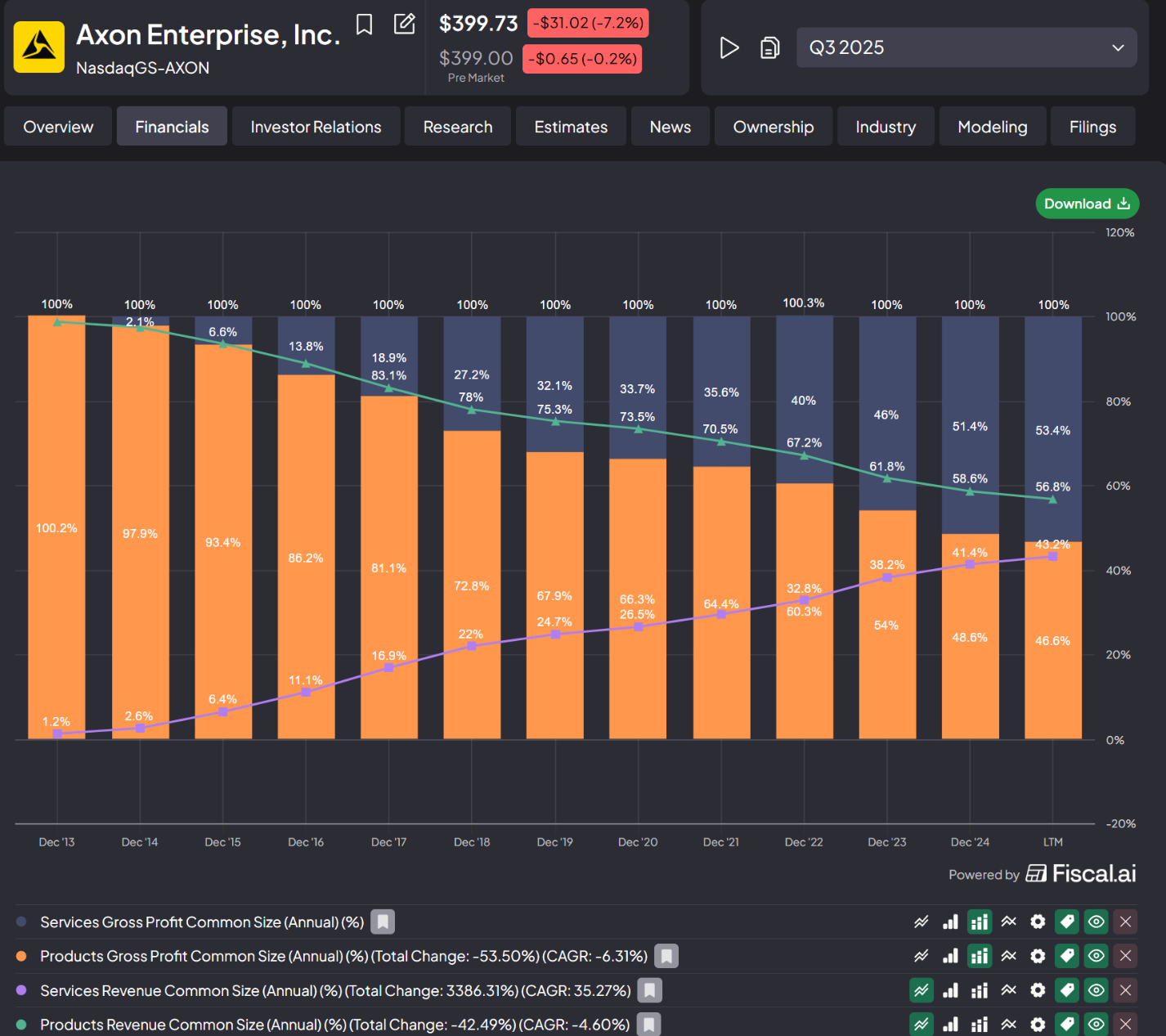

The chart below illustrates Axon’s evolution over the past decade by comparing product versus services revenue mix (line chart) alongside product versus services gross profit contribution (bar chart).

Two trends stand out clearly.

First, services revenue has grown steadily from a negligible share a decade ago to 43.2 percent today, while product revenue has correspondingly declined as a percentage of total revenue to 56.8%.

Second, and more importantly, services have already overtaken products as the dominant contributor to gross profit, despite products still accounting for a larger share of reported revenue (56.8%).

In other words, Axon is already generating the majority of its gross profit from its higher-margin services business (Cloud & Software offerings) before the revenue mix has substantially shifted away from the lower-margin hardware business (Tasers, bodycam, etc.)

As revenue continues to skew toward services, supported by software scalability and contractual recurring revenue, the company is approaching a tipping point where operating leverage should begin to accelerate meaningfully. At that stage, incremental revenue growth is likely to translate into disproportionately higher operating income and free cash flow, driving structurally improved profitability over time. It would be silly of me to let go of the stock just because of short-term volatility, given the company looks to be crossing this rubicon of profitability soon!

Reason 3: Taser Apollo darts

This year, Axon will unveil the most important catalyst of the stock, the Apollo darts. This is the biggest innovative breakthrough ever since Axon introduced NMI (Neuromuscular Incapacitation) in the M26, more than 20 years ago. You kind of have to watch this demo video (1:52:50 mark) to understand how important this is.

And per the earnings call last year, Rick Smith was quoted as saying "we're about a year out from scaled automated production", which means we should hear more about it either in the upcoming earnings call on 24th February 2026 or in the Q2 earnings call. This is a huge deal because the Apollo dart (compatible with Taser 10) significantly increases probe reliability and reaches near firearm-level consistency whilst not lethally penetrating humans. It massively expands the addressable market where reliability has been an issue:

- Cold-weather regions with thick clothing

- International police agencies that require more reliability on par with traditional firearms

- Corrections with fights in confined spaces

A Taser that works reliably across all clothing and weather conditions could potentially rival even the 9mm pistol as the default first option. In addition, Taser adoption is usually the first "Trojan Horse" into new customer contracts, where Axon can upsell the rest of its offerings in the flow of Taser -> Bodycams -> Evidence.com -> AI Software, etc.

No way am I missing out on the biggest catalyst that is about to happen to the company just because of short-term volatility!

My Next Investment Steps in the coming days & Valuation buy levels:

Note: The following does not constitute financial advice/recommendation and is merely a journal of my own portfolio investment actions.

Apart from identifying a strong growth stock, there are 2 more ingredients to make money long-term in the markets as a growth investor:

- Patience (Long-termism)

- Valuation/Buying technique

Valuation & Buying technique is how my average cost on a $90,000+ position is kept low at USD429.46 despite Axon's stock reaching as high as USD885 at its peak and me averaging in with 6 more shots after the initial USD290 buy.

Before earnings on 24th Feb, I foresee lots of volatility in this stock and I intend to capitalize on it but with caution (we're in a temporary downtrend, given the recent SAASpocalypse software narrative that has pulled Axon down as well).

Premium subscribers will receive a notification of my transactions by email, should I fire new shots into this position at my pre-determined valuation levels in the coming days/weeks.

The valuation buy levels and my next investment steps into Axon are to...

(🔒Unlock below with premium tier):