3 Investment opportunities on my mind now: Loading my Bazooka

I'll keep this article really short and get straight to the point.

I'd have preferred to increase my cash position for reasons stated in this article relating to AI scaling skepticism, but it seems the market is dropping me a few presents that I cannot ignore.

There are 3 options I'm potentially firing a very fat shot of capital into soon.

Option 1: Deeply-beaten down SaaS Software companies

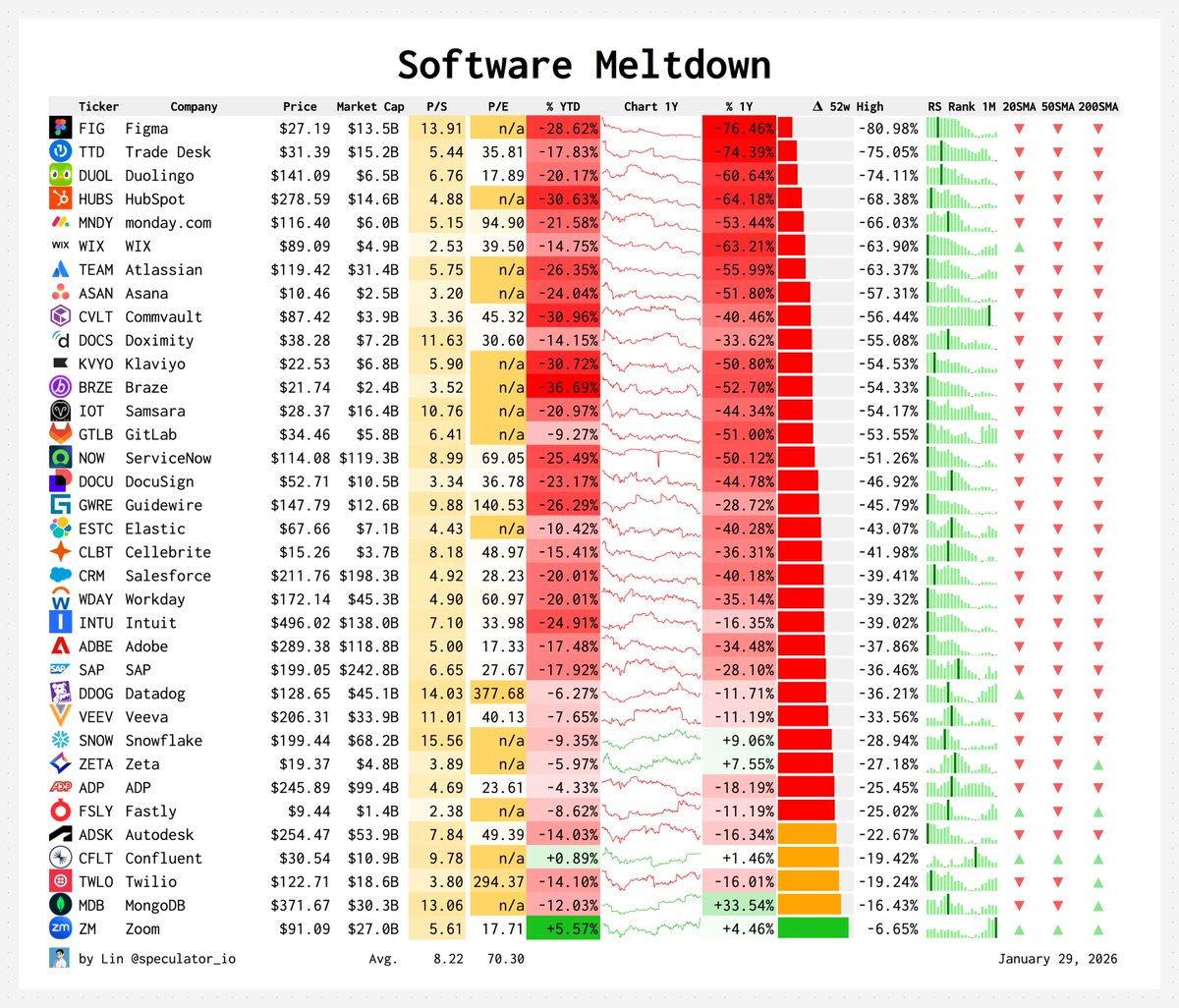

A huge no. of SaaS (Software as a Service) stocks are down >20% from their 52-week highs at the moment.

There are 2 major narratives behind this:

- Companies can use AI to quickly code and build their own software solutions and no longer need to buy SaaS software

- Companies are replacing their workers with AI Agents, so seat-based SaaS companies will earn less in the future since the way they charge is at risk

Here's my take as an engineer and/or actual user of some of these software at work:

Narrative (a) is true for some software stocks which have shallow depth affordable switching costs (see this article), but is no way in hell replacing software companies that have much more complex and expensive switching costs.

A few examples of shallow-depth software in my opinion (not exhaustive and warning.. this will be quite damning haha),

- Monday.com

- Salesforce (yes.. I'll give it at most a 'medium' in terms of switching costs)

- Atlassian

- HubSpot

- Asana

- Wix

- Duolingo

- Zoom

- Klaviyo

In this age of AI, it really isn't that difficult to quickly build an internal company clone of what these guys do and migrate data out of them (this is more hassle than exorbitant cost).

I'm still going through the list of all the SaaS companies in the screenshot above and so far one particular company has already caught my eye, which I believe possesses an expensive switching cost moat that is very unlikely to be replaced by AI, with management that has substantial skin in the game (I'll share it more below in the paywall section, but full disclosure and caveat, I'm still 50% through researching it so won't 100% commit it to my watchlist yet. But once I'm done, I'll likely write a full deep-dive article and release it here on this site to share if it does pass my 9-step criteria per this article. Deep-dives take a really long time for me to thoroughly research, so bear with me!).

Option 2: Netflix

For reasons stated in this article where I believe the WBD deal is long-term accretive.

Option 3: AXON

Down ~50% from its 52 week ATH, moving down in sympathy with the rest of the SaaS stocks - which in my opinion is silly since the company is an integrated hardware+software ecosystem as opposed to a SaaS company (The market probably mistook the Officer Safety Subscription Plan for a pure play SaaS model). For a read of my full thesis on AXON, refer to this article.

Out of the above 3 options, I am most likely making a move on one of them, and am watching the valuation and price action very closely.

I share my reasonings behind my priority choice as well as the timing of how I'm approaching each option below:

My Next Investment Steps:

Note: The following does not constitute financial advice/recommendations and is merely a journal of my own portfolio investment actions.

See below: (🔒Unlock with premium tier):

My top priority where I am soon and likely firing a fat pitch into is...